For the 24 hours to 23:00 GMT, the AUD rose 0.09% against the USD and closed at 0.7816.

LME Copper prices declined 1.4% or $95.5/MT to $6873.0/MT. Aluminium prices declined 1.1% or $23.5/MT to $2112.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7833, with the AUD trading 0.22% higher against the USD from yesterday’s close, after latest data revealed that Australia’s trade balance returned to surplus in January.

Overnight data indicated that, Australia reported a seasonally adjusted trade surplus of A$1055.0 million in January, beating market expectations for a surplus of A$160.0 million, amid a sharp fall in imports. The nation had registered a revised trade deficit of A$1146.0 million in the prior month.

Elsewhere, in China, Australia’s largest trading partner, trade surplus climbed more-than-estimated to $33.74 billion in February, after registering a revised surplus of $20.35 billion in the previous month. Markets were expecting the country’s trade deficit to stand at $5.70 billion.

Moreover, the nation’s exports surged more-than-estimated by 44.5% on an annual basis in February, accelerating at its fastest pace in 3 years. Exports had recorded a rise of 11.1% in the prior month, while investors had envisaged for a gain of 11.0%. Further, the nation’s imports registered a rise of 6.3% YoY in February, falling short of market expectations for an advance of 8.0%. Imports had risen by a revised 36.8% in the prior month.

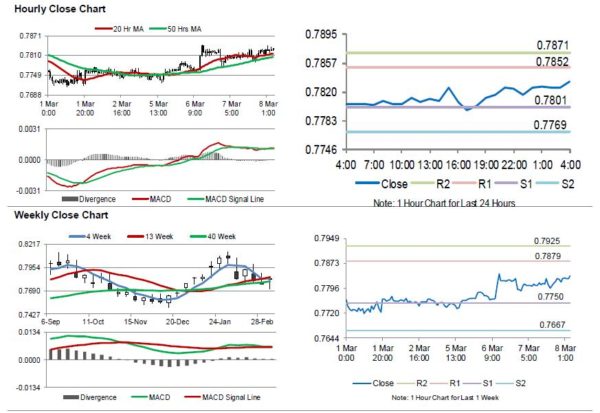

The pair is expected to find support at 0.7801, and a fall through could take it to the next support level of 0.7769. The pair is expected to find its first resistance at 0.7852, and a rise through could take it to the next resistance level of 0.7871.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.