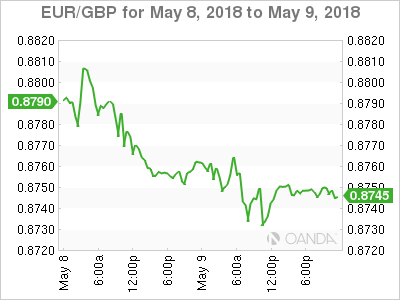

With the Bank of England (BoE) widely expected to hold interest rates steady this morning (07:00 am EDT) after recent comments from Governor Carney and weaker economic data, the key focal point for many will be whether U.K policy makers will signal a rise in August. The current odd’s for a hike today is +10%. The vote is expected to be a unanimous 9-0 decision.

Hawkish hold

A ‘hawkish hold’ from the BoE meeting would mean the central bank is expected to reiterate its commitment to raising rates in the coming months. To many, this seems justified despite the recent slowdown in economic growth – U.K GDP for Q2 rose by +0.1% q/q, below a market forecast of +0.3%.

Fixed income dealers are currently pricing in just over +50% probability of another rate hike in the BoE’s August meeting. A summer hike again becomes dependent on U.K data to improve in order to keep rate-increase expectations on track.

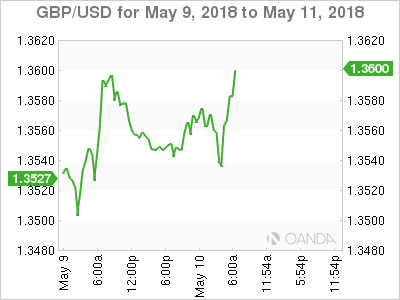

Sterling ‘bulls’ will be hoping that the BoE keeps the prospect of a summer hike alive, as they will be expecting GBP (£1.3570) to find some much needed support after the poor run in the last few weeks.

Pound ‘bears’ will be exposed to renewed weakness if the BoE does not give a clear signal and that it’s still considering raising rates further this year. For now, rate uncertainty is keeping GBP confined to tighter ranges.

A summer hike again becomes dependent on U.K data to improve in order to keep rate-increase expectations on track.

U.K manufacturing output disappoints

Sterling has risen slightly since data this morning showed that the U.K manufacturing output fell -0.1% in March – the second straight drop after almost a year of growth – in another sign that the economy is in a soft patch, though the fall was less steep than the -0.2% expected by the street. According to the ONS, the sector was dragged down by weaker electrical equipment and pharmaceutical production.