Here are the latest developments in global markets:

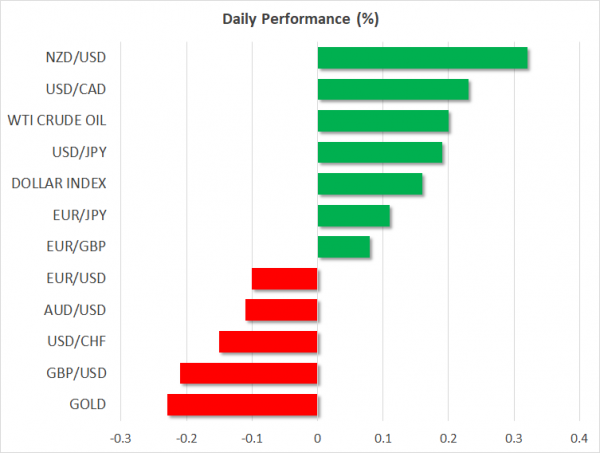

FOREX: The US dollar index edged higher on Friday (-0.05%), approaching once again the 5-month high of 93.63. The greenback remains one of the best-performing currencies this week, drawing support from the surge in 10-year US Treasury yields. Dollar/yen jumped to a new 4-month high near the 111.00 handle, adding 0.17% to its performance today. Euro/dollar inched down to 1.1777 (-0.11%) and approaches the 2018 low of 1.1762. The pair is set to post the fifth consecutive red week as political uncertainty in Italy kept investors cautious. Pound/dollar declined by 0.21% on Friday, after the government denied earlier reports on Thursday that it may consider staying in the customs union beyond 2021. In the antipodean sphere, aussie/dollar ticked lower by 0.08% to 0.7504, while kiwi/dollar advanced by 0.34% and hovered near the 0.6900 handle. Dollar/loonie was moving higher by 0.18% to 1.2826 ahead of Canadian inflation and retail sales data due for release later in the day.

STOCKS: European stocks were mixed on Friday at 1015 GMT. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 were up by 0.04% and 0.06% respectively. In Germany, the DAX rose by 0.03%, and it hit a fresh 15-month high of 13,133 earlier in the day. The French CAC 40 fell 0.26%, while in Italy, the FTSE MIB 100 was down by 0.15% as Italy’s two anti-establishment parties have signed an accord to form a ruling coalition. The British FTSE 100 was down on the day (+0.02%) and the Spanish IBEX 35 fell by 0.07%. Turning to the US, futures tracking the Dow Jones, S&P 500, and Nasdaq 100 were all in positive territory, pointing to a higher open today.

COMMODITIES: Oil prices edged up during the European trading session Friday, trading a few cents below the multi-year highs reached on Thursday’ session. WTI crude was up by 0.25% to $71.67 per barrel, while Brent advanced by 0.54% to $79.73 and is set to complete the sixth consecutive week of gains. In precious metals, gold prices edged lower by 0.24%, marking a fresh low for the year of $1,285.41.

Day ahead: Canadian inflation prints eyed; Potential trade comments also on the menu

On the data front, Canada’s inflation and retail sales data will probably attract the most attention. Besides those, any developments in the ongoing US-China trade talks in Washington could also attract attention.

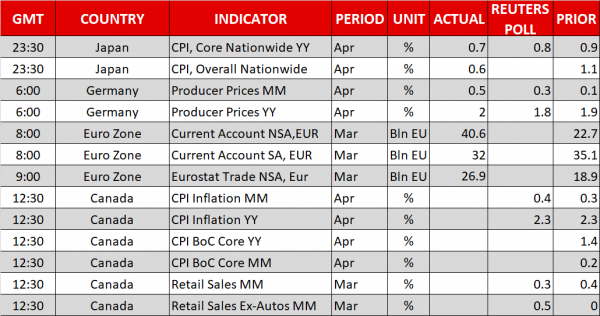

At 1230 GMT, Canada will see the release of its inflation data for April. The headline CPI rate is expected to have held steady at 2.3% in yearly terms, while no forecast is available for the core rate, which excludes the effects of volatile items such as food and energy. As for retail sales, expectations are mixed. On a monthly basis, the headline print is expected to have to have risen by 0.3% in March, down from 0.4% in February. Meanwhile, the core rate is anticipated to clock in at 0.5% month-on-month, after posting no growth previously.

Recall that at its latest policy meeting, the Bank of Canada (BoC) maintained a relatively cautious stance, dismissing the recent surge in inflation as reflecting mostly transitory factors that will fade over time. Hence, these data will likely be instrumental in shaping expectations regarding the timing of the Bank’s next rate increase; markets currently see a 40% probability for a hike at the May 30 meeting. A strong set of prints that pushes that probability higher could work in favor of the loonie, and vice versa.

On the trade front, negotiations between US and China continue in Washington. Talks appeared to be gaining momentum after media reports suggested China had presented the US with proposals to reduce the trade deficit between the two by $200 billion. However, China’s foreign ministry subsequently denied it made such an offer. Given this confusion, investors will likely look to comments from the officials themselves upon completion of the talks today, to gauge whether there has been progress. Any signs the talks are moving forward could support riskier assets, such as stocks. The opposite holds true as well.

In energy markets, attention will turn to the Baker Hughes oil rig count at 1700 GMT, for a fresh indication of whether US production continues to soar.

As for the speakers, Fed Board Governor Lael Brainard (permanent FOMC voter) will deliver remarks at 1315 GMT, while Dallas Fed President Robert Kaplan (non-voter for 2018) will also step up to the rostrum at the same time.