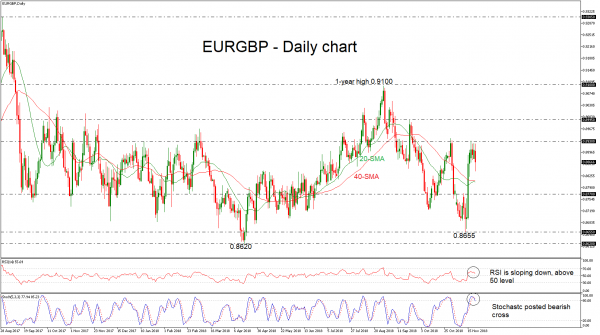

EURGBP is recording strong losses today after the pair found strong resistance obstacle near the 0.8930 barrier. Negative risks remain in the background as the RSI increases momentum to the downside in the positive region, while the %K line of the stochastic oscillator posted a bearish cross with the %D line above the 80 level.

A decline in the price may retest the 20- and 40-simple moving averages (SMAs), which hold near the 0.8800 handle. Further down, the next stop could be at the 0.8770 support, taken from the inside swing on November 12, where any violation would resume the downleg from 0.9100 towards the 0.8655 support.

Should the market stretch north, immediate resistance is expected to come from the 0.8930 hurdle. A break higher would shift focus to 0.8995, registered on September 21, which tried to halt upside movements several times in the past. Above that, investors would be interested to see whether bullish dynamics can overcome the previous peak and meet the one-year high of 0.9100.

Overall, both the short- and medium-term outlooks are looking predominantly neutral at the moment.