The Euro eases from six-week high at 1.1448, posted after strong bullish acceleration on Wednesday.

The pair advanced 0.66% on Wednesday (the biggest one-day rally since 25 Jan) after Fed surprised markets with its ultra-dovish stance and smashed the US dollar.

Traders took profit from four-day rally which accelerated on Wednesday, pushing the price lower.

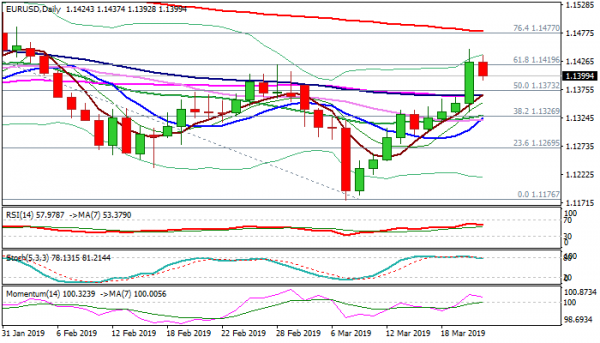

Wednesday’s rally generated several bullish signals on break above important technical barriers, surging through converged 55/100SMA’s, daily cloud and closed above Fibo 61.8% of 1.1569/1.1176 fall at 1.1420.

Current easing could be seen as positioning for fresh upside, with extended dips expected to find ground above broken 55/100SMA barrier, now reverted to support and reinforced by bull-cross with 5SMA, to keep bulls in play.

Repeated close above Fibo barrier at 1.1420 is needed to confirm bullish stance and open way for extension towards 200SMA (1.1481).

Res: 1.1420, 1.1448, 1.1477, 1.1500

Sup: 1.1392, 1.1366, 1.1344, 1.1328