Key Highlights

- The Euro declined heavily, tested 1.1140, and recently bounced back against the US Dollar.

- A key bullish trend line is forming with support near 1.1170 on the 4-hours chart of EUR/USD.

- The US Nonfarm Payrolls increased 263K in April 2019, better than the 185K forecast.

- The Euro Zone Services PMI in April 2019 is likely to remain stable at 52.5.

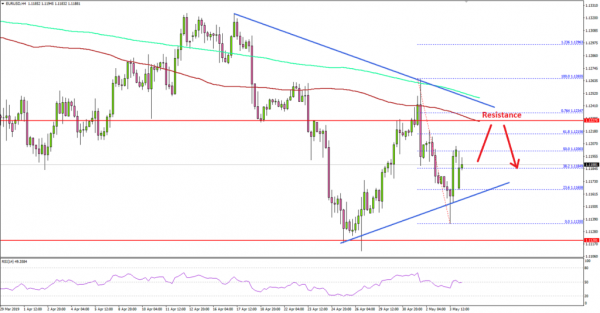

EURUSD Technical Analysis

This past week, the Euro declined heavily below the 1.1250 and 1.1200 support levels against the US Dollar. The EUR/USD pair tested the 1.1140 support level and recently started an upside correction.

Looking at the 4-hours chart, the pair traded as low as 1.1135 and recently corrected above the 1.1170. There was a break above the 1.1185 level and the 50% Fib retracement level of the last decline from the 1.1265 high to 1.1135 low.

However, there are many hurdles on the upside near the 1.1225 and 1.1240 levels. The previous support arear near 1.1230 is likely to act as a strong resistance along with the 100 simple moving average (red, 4-hours).

The main resistance is near 1.1240, a connecting bearish trend line, the 76.4% Fib retracement level of the last decline from the 1.1265 high to 1.1135 low, and the 200 simple moving average (green, 4-hours).

Therefore, a successful close above the 1.1250 level is needed for a strong rebound in EUR/USD towards 1.1300 or 1.1320. If not, the pair remains vulnerable and it could decline back to 1.1140.

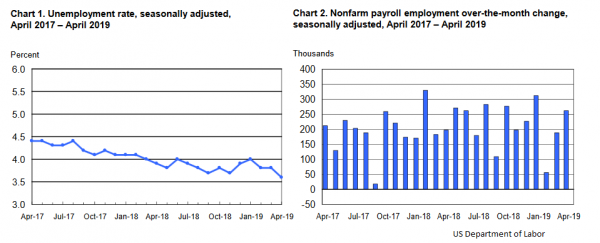

Fundamentally, the US nonfarm payrolls report for April 2019 was released by the US Department of Labor. The market was looking for an increase of around 185K, less than the last 196K.

However, the result was well above the market forecast, as the total nonfarm payroll employment increased by 263K in April 2019. On the other hand, the last reading was revised down from 196K to 189K. Looking at the unemployment rate, there was a drop from 3.8% to 3.6%.

The report added:

The unemployment rate declined by 0.2 percentage point to 3.6 percent in April, the lowest rate since December 1969. Over the month, the number of unemployed persons decreased by 387,000 to 5.8 million.

There was a sharp increase in the risk sentiment after the release, and pairs like EUR/USD and GBP/USD bounced back sharply. Besides, there was an increase in selling pressure on USD/JPY. In the short term, there could be a downside correction in the US Dollar, but it might come back strongly later.

Economic Releases to Watch Today

Germany’s Services PMI for April 2019 – Forecast 55.6, versus 55.6 previous.

Euro Zone Services PMI for April 2019 – Forecast 52.5, versus 52.5 previous.

Euro Zone Retail Sales for March 2019 (YoY) – Forecast +2.3%, versus +2.8% previous.