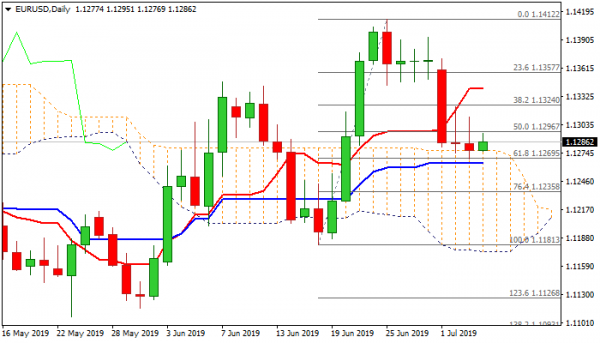

The Euro is holding just above daily cloud top which contains downside attempts for the third consecutive day, but upside remains limited. Repeated Dojis with long upper shadows in past two days signal indecision but also strong recovery rejections, as upside attempts repeatedly failed to close above 20SMA (currently at 1.1302). On the other side, thick daily cloud continues to obstruct bears, but will start thinning and eventually twist next week that could attract fresh weakness. Daily studies show mixed signals as bullish momentum continues to rise, stochastic is turning north in deep oversold zone, but MA’s are in mixed setup and RSI is flat in neutral zone. Lower volumes due to US holiday are expected to keep the pair within familiar levels, as all eyes turn towards US NFP data on Friday. US economy is expected to add 160K new jobs in Jun compared to last month’s surprise drop to 75K, with earnings expected to rise (0.3% f/c vs 0.2% prev) that could boost dollar if release comes at / above expectations. On the other side, US ADP private sector jobs report, released on Tuesday and often used as an indication for more significant NFP report, fell below expectations (June 102K vs 140K f/c), warning of NFP report downside surprise that would push Euro higher. Daily cloud top (1.1277) and Fibo level (1.1269), reinforced by rising 30DMA, mark key supports, break of which would generate strong bearish signal for extension of pullback from 1.1412 high. Conversely, lift above 20SMA would ease downside risk, but recovery would need clear break above 200DMA (1.1335) to neutralize bears.

Res: 1.1302, 1.1324, 1.1335, 1.1357

Sup: 1.1277, 1.1269, 1.1260, 1.1235