Key Highlights

- The British Pound started an upside correction above 1.2100 against the US Dollar.

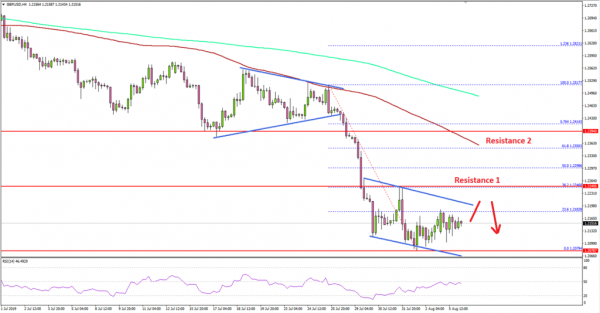

- A declining channel is forming with resistance near 1.2205 on the 4-hours chart of GBP/USD.

- The UK Services PMI in July 2019 increased from 50.2 to 51.4.

- The US IBD/TIPP Economic Optimism Index in August 2019 might decline from 56.6 to 54.6.

GBPUSD Technical Analysis

This past week, the British Pound declined significantly below the 1.2400 and 1.2250 support levels against the US Dollar. The GBP/USD pair traded as low as 1.2079 and recently started a short term upside correction.

Looking at the 4-hours chart, the pair started a strong drop from the 1.2517 swing high and after it failed to surpass the 100 simple moving average (red, 4-hours).

There was a downside break below a contracting triangle at 1.2445 to start the downward move. The pair broke many supports and settled below the 1.2250 pivot level. A swing low was formed near 1.2079 and the pair is currently consolidating losses, with corrective moves.

The pair corrected above the 1.2150 level and tested the 23.6% Fib retracement level of the decline from the 1.2517 high to 1.2079 low. However, there are many resistances on the upside near the 1.2200 and 1.2220 levels.

More importantly, there is a declining channel forming with resistance near 1.2205 on the same chart. Above the channel resistance, the main resistance is near the 1.2250 level plus the 38.2% Fib retracement level of the decline from the 1.2517 high to 1.2079 low.

If there is a successful break above the 1.2250 resistance, the pair could continue to recover towards the 1.2320 and 1.2400 resistance levels.

Conversely, if there is no upside break above 1.2205 or 1.2250, the pair could resume its decline. On the downside, an immediate support is near the 1.2120 and 1.2100 levels. Any further losses may perhaps push the pair towards the 1.2040 support area.

Fundamentally, the UK Services PMI report for July 2019 was released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The market was looking for no change in the PMI from the last reading of 50.2.

The actual result better than the forecast as the UK Services PMI increased from 50.2 to 51.4, signaling a modest increase in service sector output.

The report added that:

July data signaled a slight improvement in the performance of the UK service sector, with a renewed increase in new work supporting the fastest pace of business activity growth since October 2018. However, the rate of expansion remained subdued overall and much softer than seen on average over the past decade.

Overall, GBP/USD could correct higher in the near term, but a successful break above 1.2250 is needed for more gains.

Economic Releases to Watch Today

German Factory Orders for June 2019 (MoM) – Forecast +0.5%, versus -2.2% previous.

US IBD/TIPP Economic Optimism Index for August 2019 (MoM) – Forecast 54.6, versus 56.6 previous.