Key Highlights

- The US Dollar is trading nicely above the key support at 107.00 against the Japanese Yen.

- Earlier, USD/JPY traded below a major bullish trend line at 108.10 on the 4-hours chart.

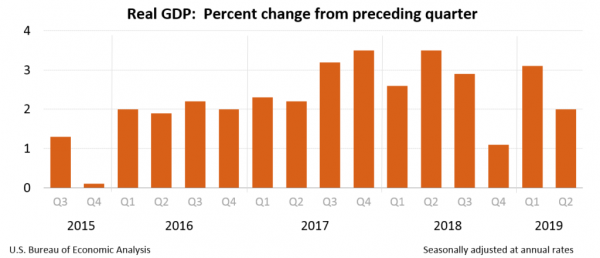

- The US GDP grew 2% in Q2 2019, similar to the market forecast and the last reading.

- The US Personal Income could rise 0.4% in August 2019 (MoM), better than the last +0.1%.

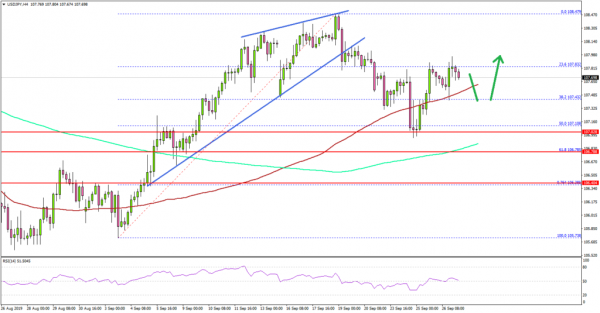

USD/JPY Technical Analysis

The US Dollar followed a bullish path above the 106.50 level in the past few weeks against the Japanese Yen. The USD/JPY pair even climbed above 108.00, but it failed to surpass 108.50 and corrected below 107.50.

Looking at the 4-hours chart, the pair traded as high as 108.47 this month before starting a downside correction. There was a break below the 108.40 and 108.00 support levels.

Moreover, the pair traded below a major bullish trend line at 108.10 on the same chart to move into a short term bearish zone. It opened the doors for more losses below the 107.50 support and the 100 simple moving average (red, 4-hours).

The pair tested the 107.00 support area and bounced back above 107.50. However, the pair is facing a lot of hurdles on the upside near the 107.80 and 108.00 levels. Therefore, a successful break above 108.00 is needed for a fresh increase towards 108.50 or even 109.00.

If the pair fails to break the 108.00 resistance, it could extend its decline. The key support is near 107.00, below which the pair could test the 106.75 support and the 200 simple moving average (green, 4-hours). Any further losses may perhaps drift USD/JPY towards the 106.20 support area.

Fundamentally, the US Gross Domestic Product report for Q2 2019 was released by the US Bureau of Economic Analysis. The market forecast was a 2.0% rise in the GDP, similar to the last reading.

The actual result was in line with the forecast, as the US GDP grew 2.0%, according to the “third” estimate released by the Bureau of Economic Analysis.

The report added:

Current-dollar GDP increased 4.7 percent, or $241.5 billion, in the second quarter to a level of $21.34 trillion. In the first quarter, current-dollar GDP increased 3.9 percent, or $201.0 billion.

Overall, USD/JPY might correct further towards 107.00 or 106.75 before it could start a fresh increase. Looking at EUR/USD, the pair dipped and revisited the 1.0925 monthly support. Moreover, GBP/USD started showing bearish signs below the 1.2400 support.

Upcoming Economic Releases

- US Personal Income for August 2019 (MoM) – Forecast +0.4%, versus +0.1% previous.

- US Durable Goods Orders for August 2019 – Forecast -1.0% versus +2.0% previous.