Key Highlights

- USD/JPY failed to stay above 110.20 and recently corrected lower.

- There was a break below a short term bullish trend line at 109.80 on the 4-hours chart.

- The US Initial Jobless Claims for the week ending Jan 18, 2020 increased from 205K to 211K.

- The US Manufacturing PMI is likely to increase from 52.4 to 52.5 in Jan 2020 (Prelim).

USD/JPY Technical Analysis

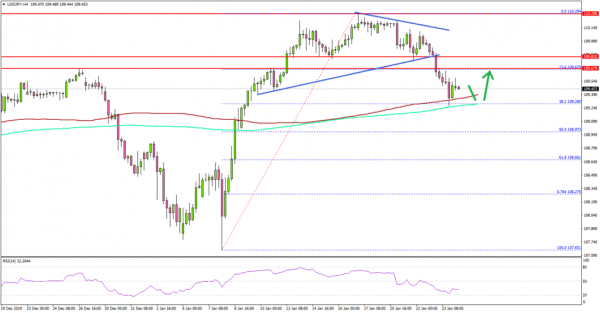

After surpassing a crucial hurdle at 109.70, USD/JPY struggled to stay above 110.20. The US Dollar traded as high as 110.29 and recently started a downside correction.

Looking at the 4-hours chart, the pair traded below the 110.00 support level. Moreover, there was a break below the 23.6% Fib retracement level of the key upward move from the 107.65 low to 110.29 high.

More importantly, the pair traded below a short term bullish trend line at 109.80. It even failed to stay above the main pivot zone at 109.70.

On the downside, the first key support is near the 109.30 area, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

If there is a downside break below the 100 SMA, USD/JPY could slide towards 109.00. The 50% Fib retracement level of the key upward move from the 107.65 low to 110.29 high is also near the 108.97 level.

Therefore, the pair is likely to find a strong buying interest near 109.30 or 109.00. On the upside, the 110.00 and 110.20 levels are important hurdles, above which the pair could climb towards 110.80.

Fundamentally, the US Initial Jobless Claims figure for the week ending Jan 18, 2020 was released by the US Department of Labor. The market was looking for an increase in claims from 204K to 215K.

The actual result was slightly better than the forecast, the US Initial Jobless Claims increased to 211K. However, the last reading was revised up from 204K to 205K.

The report added that:

The 4-week moving average was 213,250, a decrease of 3,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 216,250 to 216,500.

Overall, USD/JPY could test 109.30 or 109.00 before a fresh increase. Looking at EUR/USD, the pair is well below the 1.1120, while GBP/USD settled above the 1.3080 resistance.

Upcoming Economic Releases

- Germany’s Manufacturing PMI for Jan 2020 (Preliminary) – Forecast 44.5, versus 43.7 previous.

- Germany’s Services PMI for Jan 2020 (Preliminary) – Forecast 53.0, versus 52.9 previous.

- Euro Zone Manufacturing PMI Jan 2020 (Preliminary) – Forecast 46.8, versus 46.3 previous.

- Euro Zone Services PMI for Jan 2020 (Preliminary) – Forecast 52.8, versus 52.8 previous.

- UK Manufacturing PMI for Jan 2020 (Preliminary) – Forecast 48.9, versus 47.5 previous.

- UK Services PMI for Jan 2020 (Preliminary) – Forecast 51.0, versus 50.0 previous.

- US Manufacturing PMI for Jan 2020 (Preliminary) – Forecast 52.5, versus 52.4 previous.

- US Services PMI for Jan 2020 (Preliminary) – Forecast 52.9, versus 52.8 previous.