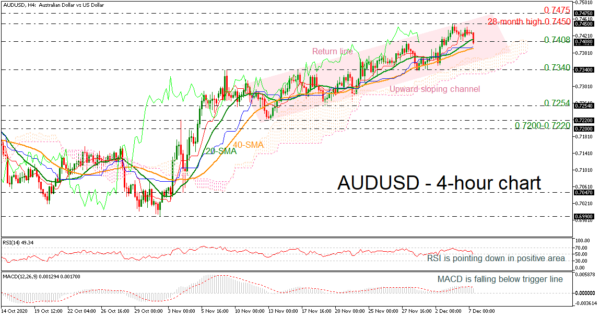

AUDUSD is falling near the 20-period simple moving average (SMA) after the bounce off the 28-month high of 0.7450, reached on December 3.

The price has been trading within an upward sloping channel over the last month. The RSI indicator is heading south in the positive territory, while the MACD is dropping beneath its trigger line in the bullish zone. Also, the pair is capped by the red Tenkan-sen line suggesting some losses in the very short-term.

Immediate support could come from the 40-period SMA at 0.7390 ahead of the upper surface of the Ichimoku cloud around 0.7368. Slipping below these lines, the next support is the 0.7340 level before touching the 0.7254 barrier. Even lower, the 0.7200-0.7220 area could attract traders’ attention.

On the other side, an upside move could hit the 28-month high of 0.7450. Above that, the price could challenge the 0.7475 resistance, registered in July 2018. Overcoming these obstacles, the 0.7675 could halt bullish movements, achieved in June 2018.

Overall, AUDUSD is looking bullish in the short- and long-term timeframes, however, a sharp decline below 0.7200 may shift this view to neutral.