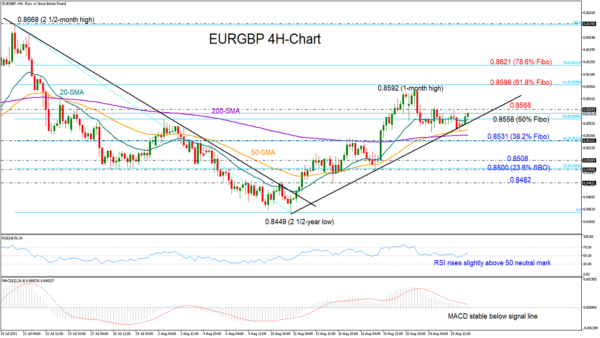

EURGBP refused to close below the 50-period simple moving average (SMA) in the four-hour chart and the supportive trendline, raising optimism that the upward pattern could see further continuation even if the flattening SMAs are providing little hope for an uptrend improvement at the moment.

The 0.8568 level is the nearest barrier, which the bulls need to successfully overcome in order to rally towards the previous peak of 0.8592 and the 61.8% Fibonacci of the 0.8668 – 0.8449 downleg. But bullish signals are still feeble as the recent rebound in the RSI is not convincing yet, while the MACD is still stuck below its red signal line despite slowing its negative momentum. Overall, a sustainable move above July’s top of 0.8668 is required to bring the bullish outlook in the broad picture back into play.

On the downside, a step below the trendline could find immediate support near its 50- and 200-period SMAs, while not far below, the 38.2% Fibonacci of 0.8531 could prevent a freefall towards the 0.8508 – 0.8500 territory, where the 23.6% Fibonacci is also located. The 0.8482 handle could be the next pivot point if selling forces persist.

All in all, EURGBP still looking neutral in the very short-term picture. A close above 0.8568 could confirm additional upside corrections, though in the big picture, only a bounce above the 0.8668 top would shift the outlook to bullish.