The dollar eases on Wednesday, as traders collected profits from the past four-day rally but also look for better levels to -re-enter bullish market, as outlook for the dollar, according to latest expectations for tomorrow’s Fed decision, remains very bullish.

The greenback rallied strongly after last week’s US inflation report which showed that prices continue to rise and inflation hit new highest in over four decades, increasing pressure on the central bank to take more aggressive steps in attempts to curb soaring inflation.

The latest polls show dramatic rise in expectations that the Fed will raise interest rates by 0.75% (the biggest increase since 1994) instead of previously dominating expectations for 0.5% hike. The notion is supported by statistics which show that bets for 0.75% increase rose to 89%, compared to last week’s 4%, while expectations for 0.5% hike dropped to 11% from last week’s wide expectations.

Higher than expected rate hike is likely to push the dollar higher, in extension of steep rally in past months, fueled by previous rate hikes and strong safe-haven demand due to growing uncertainty over the consequences from the war in Ukraine.

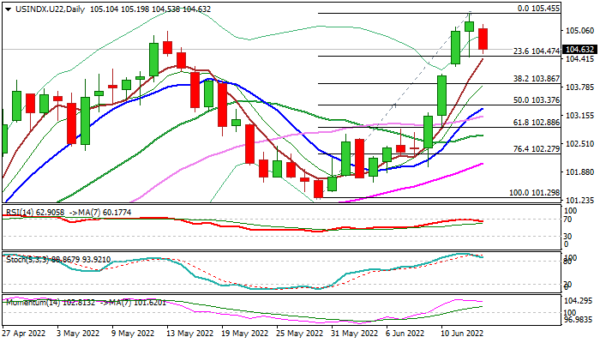

The index is holding just under new 2022 high (105.45) also the highest in two decades and could extend towards Fibo projections at 106.50/107, with possible stronger bullish acceleration to threaten 108/110 zone.

However, traders remain cautious as overbought studies warn, while also consider that strong rate hike or decision to stick to initial 0.5% hike, may disappoint markets and trigger the ‘buy the rumors – sell the facts’ scenario.

Res: 105.19; 105.45; 105.93; 106.48.

Sup: 104.47; 104.24; 103.86; 103.31.