EUR/USD

The European common currency lost some ground against the dollar, and after the test of the support at 0.9948, the pair consolidated just above the mentioned zone. If the bearish attack continues, then a confirmed breach of the aforementioned level could easily pave the way for a test of the local low at 0.9917, where a violation could strengthen the negative expectations for the future path of the EUR/USD. If the bulls prevail, then the first resistance for them can be found at the zone of 0.9996, followed by the major target at 1.0054. Important news for investors today will be the U.S. data on non-farm payrolls and that on the unemployment rate (both at 12:30 GMT).

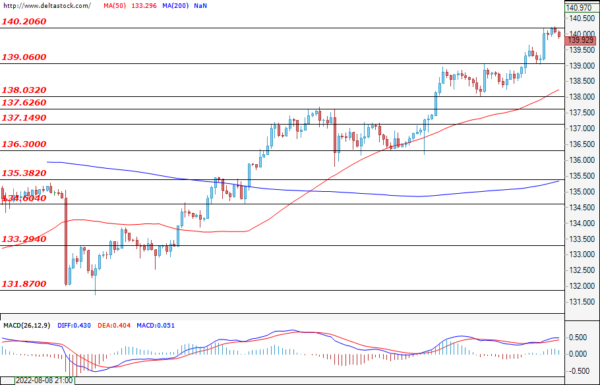

USD/JPY

The positive sentiments remained unchanged and the dollar appreciated against the yen. The pair reached historic levels from 1998 and tested the psychological resistance at 140.20. During the early hours of today`s trading, the Ninja is hovering under the mentioned zone, and the expectations are for a new attack for the bulls. A successful breach of this resistance could continue the rally and could easily lead to new gains for the USD against the JPY. If the bullish momentum fades, bears could lead the pair towards the support zone at 139.06, where a violation could deepen the correction towards the lower level at 138.03.

GBP/USD

The test of the support zone at 1.1519 was not successful, and during the time of writing the analysis, the price is holding positions around the current level at 1.1548. A new attempt for a violation of the aforementioned level is a highly probable scenario, but only a successful breach for the bears could continue the sell-off and lead the Cable towards the bottom levels from March 2020 at around 1.1420. If the bulls prevail and manage to breach the resistance at 1.1618, then they could test the next zone at 1.1689. The news, mentioned in the EUR/USD analysis, will be the driving factor for price action today.

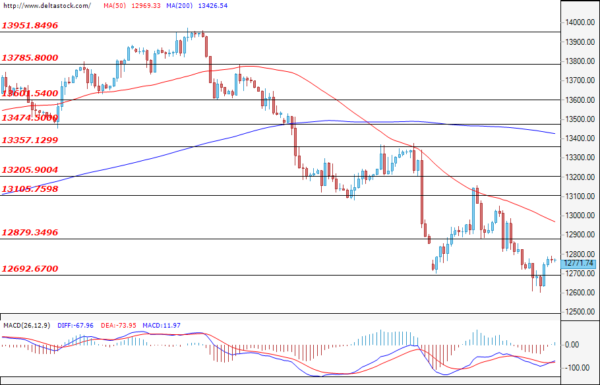

EUGERMANY40

Yesterday, the support zone at 12692 withheld the bearish attack and the German index recovered some of its recent losses. During the early hours of today, the EUGERMANY40 is trading above the mentioned support, and If the bulls prevail, then their first target would be the resistance at 12879, followed by the upper level at 13105. However, the more likely scenario is for a new attack for the bears, and a successful violation of the mentioned zone at 12692 could lead to a continual decline and could strengthen the negative expectations for the future path of the index.

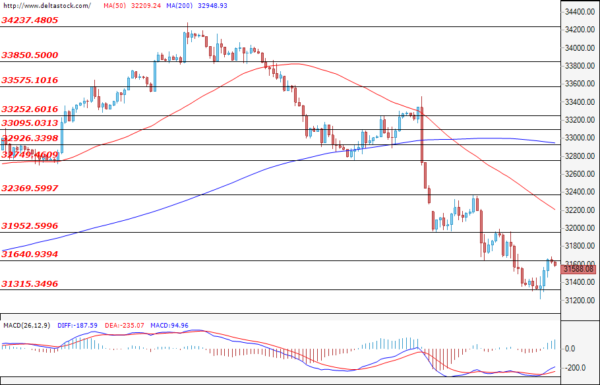

US30

The bears did not get enough momentum for a successful breach of the support at 31315 and the index bounced and tested the zone at 31640. If trading remains limited below the mentioned resistance, then a new successful attack on the support at 31315 could lead to a sell-off towards the levels at around 31100. Better-than-expected data on the non-farm payrolls change and the unemployment rate (both today at 12:30 GMT) could help the bulls prevail. A violation of the level at 31640, followed by a breach of the upper resistance at 31952, could easily lead to a correction towards the local high at 32369.