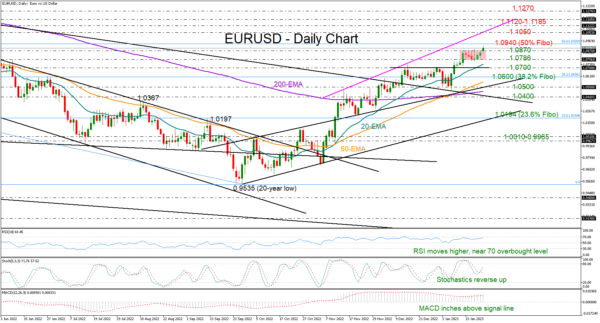

EURUSD is looking to start a new bullish cycle after gently breaking out of its weekly range to print a new nine-month high of 1.0919 earlier today.

The odds are favoring the bulls according to the technical indicators. The exponential moving averages (EMAs) are all sloping upwards, with the 50- and 200-day EMAs having recently registered a clear golden cross for the first time since June 2020. This is a solid positive sign that the four-month-old uptrend could experience further improvement. In momentum indicators, the MACD is also sending positive vibes, while the RSI and the stochastic, although near their overbought levels, have yet to show any signs of weakness.

Unless the 50% Fibonacci retracement of the 1.2348-0.9535 downleg blocks the way higher at 1.0940, the rise could continue towards the key resistance line seen around 1.1050. Slightly higher, some congestion could emerge within the 1.1120-1.1185 constraining zone taken from Q1 2022. If this proves easy to overcome, the next stop could be around the 1.1270 barrier.

In the event the pair pulls below 1.0870 and back into the weekly range, the focus will shift to the 1.0786 base. Note that the 20-day EMA is approaching that area. Hence, failure to rebound here and a decisive close below the 1.0700 psychological mark, which acted as resistance at the end of December, may spark a quick decline towards the 38.2% Fibonacci of 1.0600. Then, the spotlight will fall on the 50-day EMA and the broken upward-sloping line at 1.0500, while not far below, the broken long-term resistance trendline from May 2021 near 1.0400 could be another important area to watch.

Summing up, buying pressures are expected to persist in EURUSD in the short-term, though some consolidation around 1.0940 cannot be ruled out before the important bar at 1.1050 comes on the radar.