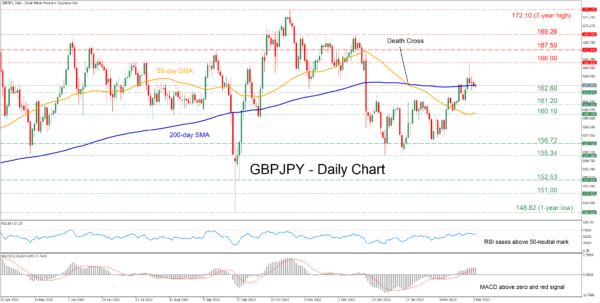

GBPJPY has been steadily gaining ground after finding its feet at the 2023 low of 155.34. In the short-term, the latest rebound seems to have stalled and the price has experienced a moderate pullback despite its temporary break above the 200-day simple moving average (SMA).

The momentum indicators currently suggest that bullish forces remain in control. Specifically, the RSI is flatlining above its 50-neutral mark, while the MACD histogram is strengthening above both zero and its red signal line.

If the positive momentum strengthens, the pair could test its recent rejection region of 166.00. Piercing through that zone, the bulls might aim for the September peak of 167.50 before the spotlight turns to the 169.26 hurdle. A break above the latter may pave the way for the seven-year high of 172.10.

On the flipside, should the price drop beneath the 200-day SMA, initial support could be found at the 162.60 barrier. Violating this territory, the pair might descend towards the February support of 161.20 or lower to challenge 160.10. Failing to halt there, further declines could cease at the February low of 156.72.

In brief, GBPJPY retraced lower after its advance got rejected, but near-term risks remain tilted to the upside. Therefore, a clear close above the 200-day SMA could revive the bulls’ hopes for the continuation of the recent upside move.