USDJPY gained extra ground within the 132.00 region on a relatively quiet day on Monday as several major markets remained closed for the Easter holidays.

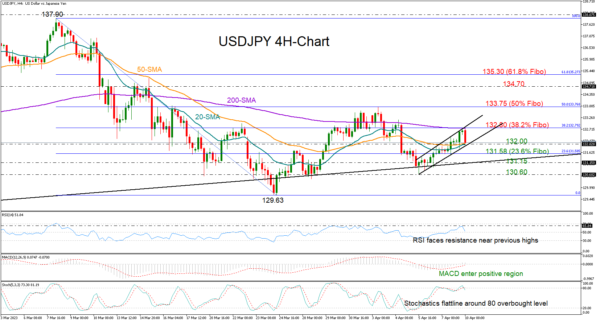

Despite the encouraging start to the day, the bullish correction ran out of steam soon after touching the 200-period exponential moving average (EMA) on the four-hour chart and the familiar resistance of 132.80, which represents the 38.2% Fibonacci retracement of the 137.90-129.63 downleg. The pair also seems to have reversed near the upper boundary of a tight bullish channel.

With the Stochastic oscillator hovering within the overbought zone and the RSI coming under pressure near its previous highs, we cannot rule out a downside move. Yet, only a decisive close below the 132.00 number, where the 20- and 50-period EMAs are located, could confirm an extension towards the 23.6% Fibonacci level of 131.58. If the bears breach the support trendline from January’s lows at 131.15 too, the decline could reach the 130.60 handle, while deeper, the door would open for the March trough of 129.63.

On the upside, the pair will need a successful close above the 132.80 bar for a quick advance up to the 50% Fibonacci mark of 133.75. Another step higher could add more fuel to the rally, bringing the 134.70-135.30 constraining zone next into view.

In summary, USDJPY could remain under pressure in the short term, though only a break below 132.00 would signal a bearish continuation.