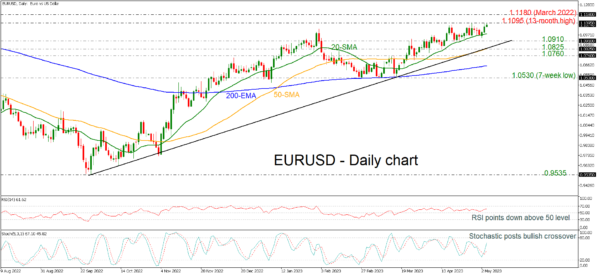

EURUSD is attempting once more to climb above the 13-month high of 1.1095, endorsing the long-term upside structure. This outlook is reinforced by the RSI, which is rising and remaining above its neutral threshold of 50. In addition, the stochastic oscillator displayed a bullish crossover between its %K and %D lines and is approaching the overbought area.

In the event of an upward price movement, the immediate 13-month high of 1.1095 that coincides with the 200-weekly simple moving average (SMA) may act as a barrier before the March 2022 high of 1.1180 can be challenged. Above these levels, the 1.1500 psychological mark, registered in February 2022 may halt bullish actions.

On the other hand, any declines should reach the 20-day SMA at 1.0980 prior to encountering the subsequent obstacles at 1.0910 and 1.0825, which are located close to the 50-day SMA. A drop below the long-term uptrend line could pave the way for the 1.0760 support and, more significantly, the 200-day EMA at 1.0650, thereby neutralizing the outlook.

To conclude, given that the pair is trading above the short-term SMAs and the uptrend line, the market appears to be in a bullish phase.