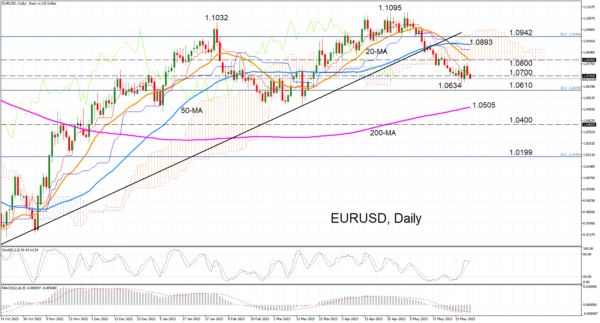

EURUSD is back under selling pressure as the rebound from last week’s two-month low of 1.0634 has suffered an early setback. The 1.0700 handle is in danger of being surrendered again as the momentum indicators aren’t looking very encouraging right now.

The fast stochastic oscillator (%K) is about to cross below the slow stochastic (%D), while the MACD has slid back below its red signal line.

If the bearish bias persists in the short term, the 38.2% Fibonacci retracement of the January 2021-September 2022 at 1.0610 is the next major support that could prop up prices. But should it fail, attention would quickly turn to the 200-day simple moving average (SMA) just above 1.0500, which also coincides with the lows from January and March. Even lower, the 1.0400 level could be targeted, before the 23.6% Fibonacci of 1.0199 comes into range.

However, if the pair is able to find its footing and bounces higher, there could be trouble in the 1.0800 region as both the 20-day SMA and the bottom of the Ichimoku cloud are barricading this area. A successful entry into the cloud would not be problem free as the 50-day SMA is hovering around 1.0893 and the 50% Fibonacci is positioned slightly higher at 1.0942.

To sum up, EURUSD’s downside correction doesn’t appear to be over yet, and should it extend all the way until the 200-day SMA, the bullish medium-term outlook would be at risk of switching to bearish. Moreover, unless the price can top the April peak of 1.1095 soon, the pair could be stuck in a consolidation phase.