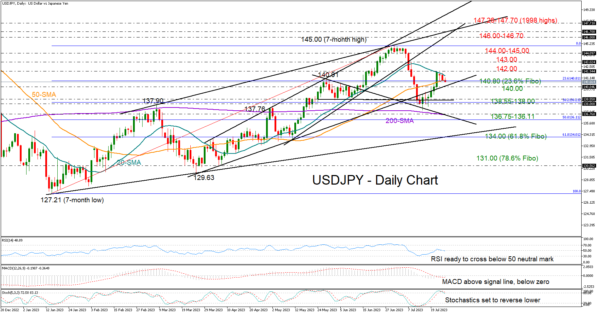

USDJPY bulls took a breather after a constructive week, which saw the pair bouncing from a low of 137.23 to a high of 141.94.

The pair recouped half of July’s freefall, but the 20-day simple moving average (SMA) has been a struggle so far this week, pushing the price softly to the downside. Encouragingly, the 50-day SMA managed to limit losses around 140.80 along with the 23.6% Fibonacci retracement of the 127.21-145.00 uptrend but buying interest seems to be negligible at the moment.

The RSI is ready to re-enter the bearish area below 50 and the Stochastic oscillator is set to reverse lower after its peak in the overbought zone. Meanwhile, the MACD remains muted below zero despite climbing above its red signal line, all showing indecisiveness among traders ahead of today’s FOMC policy announcement.

If the price builds a base around the 50-day SMA or slightly lower at 140.15, where we can find the ascending line from March, it could re-examine the 20-day SMA at 141.34. A close above the latter may not excite traders unless the price crawls above the 142.00 mark too. A victory there could see a pause around 143.00 and then an advance towards the key 144.00-145.00 resistance zone. Breaching this wall, the bulls could post a new higher high within the 146.00-146.70 trendline area, while a more aggressive increase could reach the 1998 ceiling of 147.26-147.70.

In the bearish scenario, where the pair retreats below the 140.00 psychological mark, the spotlight will turn to the 138.55-138.00 support area. If that floor cracks, the decline could expand towards the 200-day SMA and the 50% Fibonacci of 136.11. Another failure at this point might prone a significant sell-off towards the 61.8% Fibonacci level of 134.00 and the tentative support trendline from January.

To sum up, USDJPY seems to have little backing to renew bullish pressure. A negative extension below 140.00 is expected to activate strong selling. Otherwise, the pair will need to claim the 142.00 barricade to continue higher.