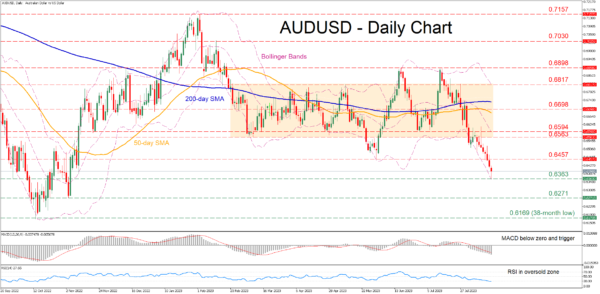

AUDUSD has been in an aggressive decline after its latest bullish breakout from the rectangle encountered resistance at 0.6898, validating a double top pattern. In the near-term, the pair is posting consecutive lower lows, with the price appearing to have approached oversold conditions as it is trading very close to the lower Bollinger band.

The momentum indicators currently suggest that the recent selloff could be overstretched. Specifically, the MACD is softening below both zero and its red signal line at its lowest levels since March, while the RSI is hovering within its 30-oversold territory.

Should the negative pressures persist, the price could initially test the 2023 bottom of 0.6363, which also held strong in September 2022. Slicing through that region, the pair might descend towards levels not seen in months, where the November 2022 low of 0.6271 could curb further downside attempts. A break below the latter could open the door for the 38-month low of 0.6169 registered in October 2022.

Alternatively, if the pair manages to halt its retreat and bounce back, a series of previous support regions such as 0.6457, 0.6563 and 6.594 could prove to be hard hurdles for the bulls to conquer. Surpassing the latter, the price might challenge 0.6698, which has acted both as resistance and support in recent months.

In brief, AUDUSD has been in a clear downtrend for the last 10 days, marking a streak of fresh 2023 lower lows as the bears seem unwilling to lift the foot off the gas. Nevertheless, traders should not rule out a potential rebound as the pair has approached oversold conditions.