BoE is generally expected to keep bank rate unchanged at 0.10% today, and hold the QE target at GBP 875B. Both decisions should be by unanimous 9-0 votes. Governor Andrew Bailey sounded upbeat about economy economy in his comments earlier this week, even though that came with “a large dose of caution”. He’s also comfortable with the rise in real interest rates, as that was “consistent with the change in the economic outlook.”

On point to note was chief economist Andy Haldane’s warning on inflation last month. He said, there is a tangible risk inflation proves more difficult to tame, requiring monetary policymakers to act more assertively than is currently priced into financial markets…. the greater risk at present is of central bank complacency allowing the inflationary (big) cat out of the bag.”

We’d watch for clues on the overall views of the MPC on the issue of growth, yields and inflation. But the details might only be provided later in May’s monetary policy report.

Here are some suggested readings on BoE

- BOE Preview – Response to Rising Yields in Focus

- Bank of England to Stick to ‘Cautionary Realism’ as UK Yields Surge

- Everything You Need To Know About The Bank Of England

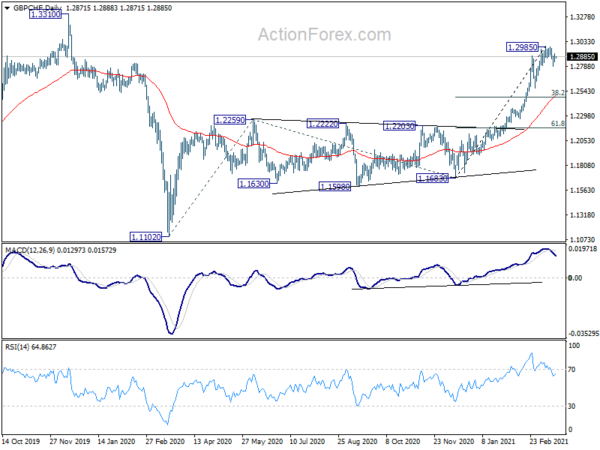

GBP/CHF defended 1.2794 minor support well so far, keeping near term outlook bullish. Consolidations from 1.2985 could be relatively brief. Break of 1.2985 will resume that larger up trend from 1.1102 low towards 1.3310 structural resistance next. Though, firm break of 1.2794 will indicate that lengthier and deeper correction is underway. Further fall could be seen towards 55 day EMA (now at 1.2506), which is close to 38.2% retracement of 1.1683 to 1.2985.