The opinions on whether BoC will raise interest today are divided. Some expected the tightening cycle to start imminently, with a total of 150bps rate hike this year to 1.75%. Yet, there are conservative opinions that BoJ would wait until April to act and deliver only 75bps hikes this year.

It should be noted that BoC has mentioned before that the condition for rate hikes would be met in the “middle quarters” of 2022. But some argued that the central bank is already behind the curve on controlling inflation. With the publishing of monetary policy report and economic projections, January and April meeting are the more appropriate choice then March. But could BoC keep its hand off until April. It’s a close call.

Some previews on BoC:

- BoC Policy Meeting: It’s Time for a Rate Hike

- Currency Pair of the Week: USD/CAD

- Bank of Canada Preview: Is the BOC Ready to Hike Rates?

- Bank of Canada to Make Highly-Anticipated Rate Decision

- Canada: Rate Hikes Close, But Not Quite Yet

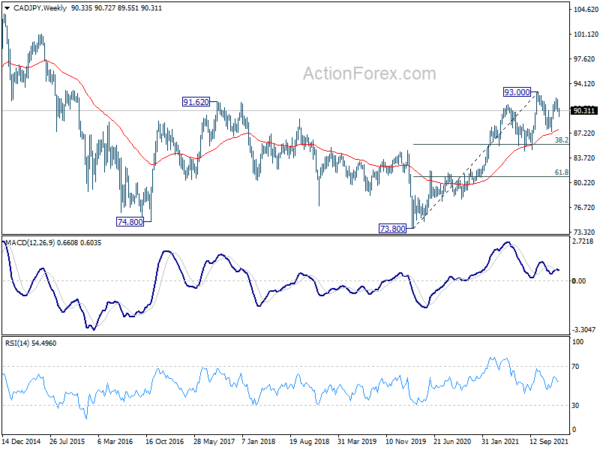

Canadian Dollar’s next move will depends on all factors including BoC, Fed and overall risk sentiment. Technically speaking, CAD/JPY is now seen as in the third leg of a consolidation pattern from 93.00. Deeper fall is in favor back to 87.42, or further to 100% projection of 93.00 to 87.42 from 92.16 at 86.58. We’re not expecting a break of 38.2% retracement of 73.80 to 93.00 at 85.66. On the upside, a firm break of 93.00 high is not expected for now give the overall mixed sentiment.

So the range should be set between 85.66 and 93.00. A strong breakout on either side would imply a rather dramatic underlying development.