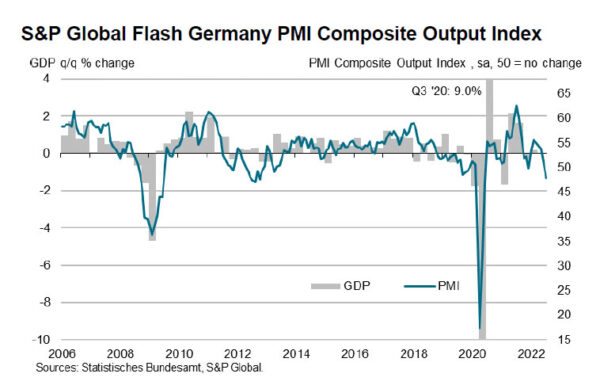

Germany PMI Manufacturing dropped from 52.0 to 49.2 in July, below expectation of 50.6. That’s the lowest level in 25 months. PMI Services dropped from 52.4 to 49.2, below expectation of 50.6. That’s the lowest level in 7 months. PMI Composite output dropped from 51.3 to 48.0, a 25- month low.

Paul Smith, Economics Director at S&P Global Market Intelligence said:

“Having enjoyed a growth boost from the previous easing of virus-related restrictions, a collision of various headwinds in July served to push the German economy into contraction territory for the first time in 2022 so far.

“Ongoing supply-delays and the uncertainty caused by the war in Ukraine continued to be reported as factors weighing on company performance, but based on a reading of anecdotal evidence, inflation and the pressures these are having on budgets was a noticeable feature behind the worst performance of private sector activity since the height of the first pandemic wave in the spring of 2020. With this in mind, whilst we are seeing a downward trend in our price indices, inflation rates remain stubbornly elevated according to the July survey.

“The decline in output was broad-based, with the downturn in manufacturing deepening, and service sector activity dropping into contraction territory for the first time since December. Moreover, given the noticeable falls in new business across both sectors, activity was somewhat prevented from experiencing a sharper fall thanks to the availability of previously secured contracts. With signs that this supportive prop is coming to an end, and warehouse inventories rising at a near-record rate in manufacturing, the outlook for output is turning increasingly negative. No wonder then company expectations have subsequently dropped into negative territory for the first time in over two years.”