Australian Dollar continues to trade as the worst performer for the week, suffering triple blow including risk aversion, free fall in copper price and RBA speculations. Copper’s selloff accelerated this week and broke to new low in 2023 today. There are increasing doubts on whether RBA will raise interest rate next week or opt for the second pause in a row after yesterday’s CPI data.

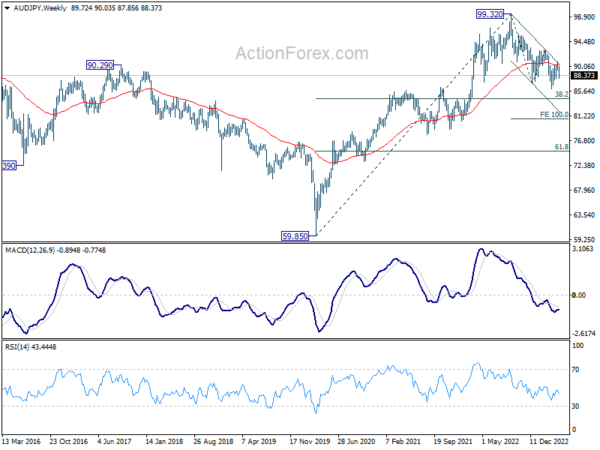

AUD/JPY is currently the second biggest mover for the week, just next to EUR/AUD. Current development indicates that corrective recovery from 86.04 has concluded with three waves up to 80.76, after being rejected by channel resistance. This implies that the larger downtrend from 99.32 (2022 high) is ongoing and may be ready to resume.

Immediate focus is now on 87.57 support. Firm break there will confirm this bearish case, and target 38.2% retracement of 59.85 to 99.32 at 84.24. Firm break there could prompt downside acceleration to 100% projection of 99.32 to 87.00 from 92.99 at 80.67. But of course, the whole development would also depend on any surprise from BoJ on Friday.

As for Copper, with breach of 3.8229 support, whole decline from 4.3556 is likely resuming. There is risk of more downside acceleration if it cannot recovery back above 3.9197 support turned resistance soon. Next target would be 100% projection of 4.3555 to 3.8229 from 4.1743 at 3.6416, which is close to 61.8% retracement of 3.1314 to 4.3556 at 3.5990, that is, around 3.6 handle. If this extended selloff in copper materializes, it could put additional pressure on Aussie.