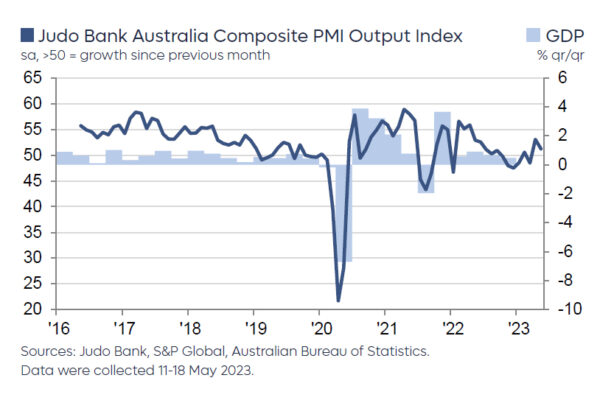

Australia’s PMI Manufacturing index stayed put at 48.0 in May, marking the joint-lowest reading since May 2020. On the other hand, PMI Services fell from 53.7 to 51.8, causing Composite PMI to decrease from 53.0 to 51.2.

Warren Hogan, Chief Economic Advisor at Judo Bank, said, “The May Flash result shows a small retracement from the strong April outcome reinforcing the view that overall economic activity in Australia is holding up well as we enter the winter months.”

Despite the manufacturing sector’s continuous slowdown, Hogan emphasized that this does not signal a recession. In contrast to manufacturing, the services sector has shown recent strength, and was “far from the risk of recession:.

However, he warned of the implications of better economic conditions in terms of inflation. “The RBA is trying to engineer a soft landing to rid the economy of inflation. But if they don’t lean hard enough on monetary policy, we could see a more stubborn inflation emerge which will ultimately require a bigger lift in interest rates,” Hogan cautioned.

Highlighting the strong correlation between the pick-up in the services PMI, housing market, rising population growth, and job advertising, he concluded, “Last week’s labour market data on employment and wages have bought the RBA some time, but the Flash PMIs highlight that it is still too early to call an end to the monetary policy tightening cycle.”