As BoC meets today, many observers anticipate the bank will maintain its pause, leaving interest rates untouched at 4.50%. However, recent economic developments have injected a dose of doubt into the mix. Market speculation reveals that there is approximately a 45% probability of a 25-basis point adjustment, making this rate decision look more like a coin toss.

The prevailing viewpoint among economists is that BoC might defer any rate changes until its July meeting. Two crucial reasons fortify this standpoint. First, the July assembly aligns with the release of a fresh batch of economic projections, offering BoC ground to justify any rate recalibrations. Second, the subsequent press conference would grant Governor Tiff Macklem the opportunity to explain their decision to a watchful audience.

However, if the central bank is indeed leaning towards a rate adjustment in July, then today’s announcement might carry a hint of hawkishness. If so, this shift could be a strategic move to prepare the markets for potential changes ahead, and give Canadian Dollar a lift.

Some previews on BoC:

- Will the BoC Resume Interest Rate Hikes?

- Forward Guidance: Canada May be in for Another Rate Hike—But July More Likely than June

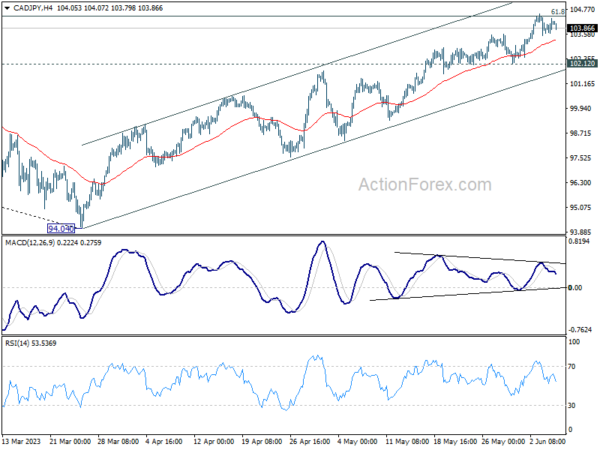

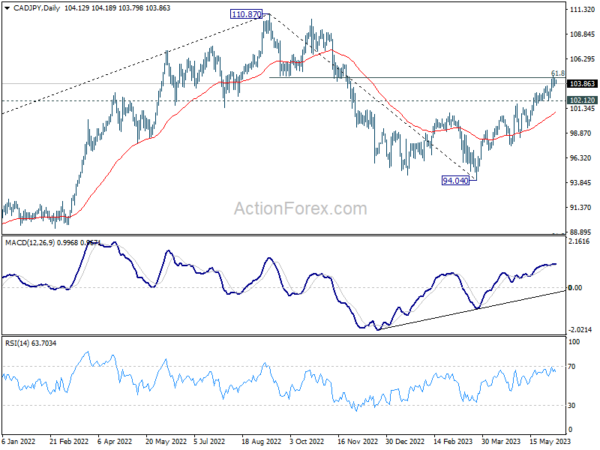

CAD/JPY has been losing upside momentum as seen in 4H MACD, even though the rally from 94.04 extended. Such rise is seen as the second leg of the corrective pattern from 110.87. It’s now pressing an important fibonacci resistance of 61.8% retracement of 110.87 to 94.04 at 104.44.

Decisive break of 104.44, as prompted by hawkish BoC, could trigger upside re-acceleration to retest 110.87 high. But for now, firm break there is not expected yet.

On the other hand, break of 102.12 support will indicate rejection by 104.44. More importantly, the pattern from 110.87 might have then started the third leg. Sustained trading below 55 D EMA (now at 100.88) would bring deeper fall back towards 94.04.