Sterling is facing headwinds after release of UK’s CPI inflation data, which came in lower than market forecasts. This development strengthens the speculation that BoE might be drawing curtains on its tightening cycle, with the one more hike expected tomorrow potentially being the concluding move.

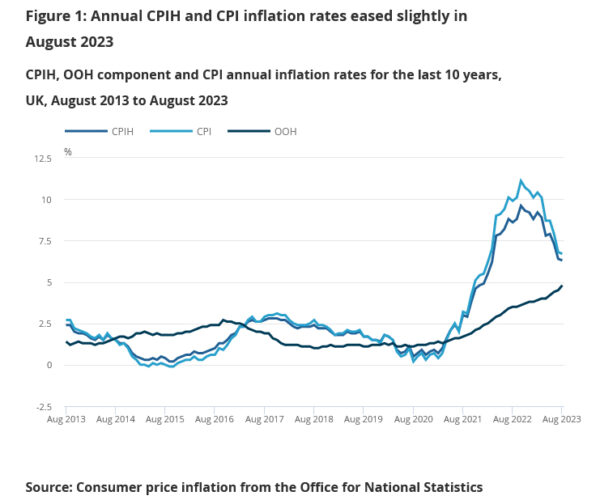

The reported data illustrated deceleration in CPI from of 6.8% yoy to 6.7% yoy in August, a result that fell short of the projected escalation to 7.1% yoy. This is the lowest rate witnessed since February 2022.

A deeper dive into the components reveals that this softening of annual CPI into August 2023 emerged from six out of the 12 sectors. Notably, restaurants and hotels, along with food and non-alcoholic beverages, played a pivotal role in pulling down the numbers. However, the motor fuels category within the transport sector exerted upward pressure, somewhat counterbalancing the decline.

Furthermore, core CPI, which is calculated by excluding variables such as energy, food, alcohol, and tobacco, followed suit, decelerating from 6.9% yoy to 6.2% yoy. This stands significantly below anticipated rate of 6.8% yoy.

Breaking it down further, while CPI goods noted a slight acceleration from 6.1% yoy to 6.3% yoy, CPI services delineated a slowdown from 7.4% yoy to 6.8% yoy.

For the month. CPI rose 0.3% mom in August, below expectation of 0.7% mom.