BoE stands at a critical juncture as it is expected to maintain its policy interest rate at 5.25% today, marking the second consecutive pause in tightening. This decision comes in the wake of September’s UK CPI remaining steady at 6.7%, defying market expectations and signaling a halt in the disinflation process. Conversely, the prevailing weak growth data underscore increasing risks of recession, placing the BoE in a challenging policy dilemma.

Today’s meeting is set to highlight the existing divides within the nine-member MPC. September’s decision, which resulted in no change, saw a tight vote, with 5 members in favour and 4 against. Given the nuanced economic picture, a shift in this balance, although unexpected, is still within the realm of possibility.

The central bank will also unveil its new economic forecasts. Given the recent string of subdued data, BoE is anticipated to downgrade its short-term projections for growth. Yet, looking further out, the bank might elevate its growth expectations for the two- and three-year marks, influenced by factors such as lower interest rates and a depreciated sterling.

One of the prevailing discussions in financial circles revolves around which major central bank will be the first to reduce interest rates. As it stands, market consensus suggests that BoE may trail its counterparts, ECB and Fed. Current projections don’t anticipate a rate cut by BoE with over a 50% likelihood until August 2024. However, should BoE’s upcoming forecasts reflect a significant downward adjustment in inflation outlook, this timeline and market sentiment could be poised for a change.

Some suggested readings on BoE:

- Bank of England’s November Interest Rate Decision and Its Potential Impact on the Pound

- Doves Firmly in Control of BoE Meeting

- Bank of England Preview – Soft Data Warrants BoE to Stay On Hold

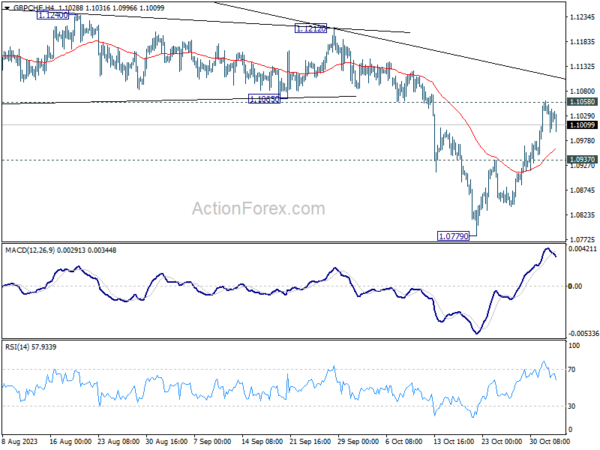

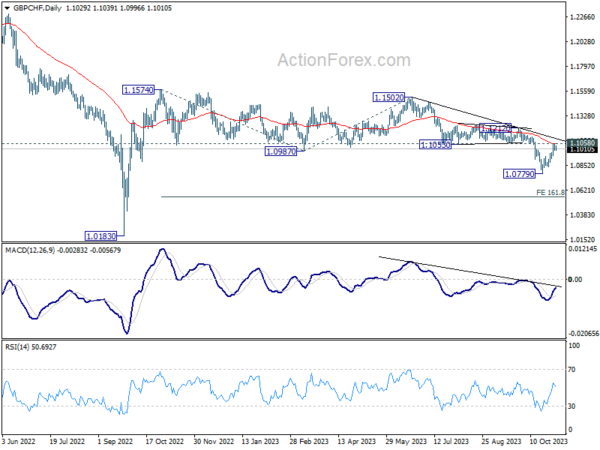

While GBP/CHF’s rebound in the last two week has been strong, it’s capped by 1.1053 support turned resistance, as well as 55 D EMA. Risk stays on the downside for larger decline from 1.1502 to continue. Break of 1.0937 minor support will retain near term bearishness, and bring retest of 1.0779 first. However, sustained break of 1.1058 will raise the chance of bullish reversal, and target 1.1212 structural resistance for confirmation.