New Zealand Dollar weakens broadly in Asian session, as market participants are likely adjusting their positions in anticipation of the upcoming RBNZ rate decision. This cautious approach stems from a blend of profit-taking and hedging against surprises that might deviate from some market expectations. Despite a robust rally earlier in the month, spurred by rate hike speculations, the prevailing market consensus leans towards a steady rate with a side of hawkish rhetoric from RBNZ. Investors are currently scaling back, wary of any outcomes that could fall short of the hawkish forecast.

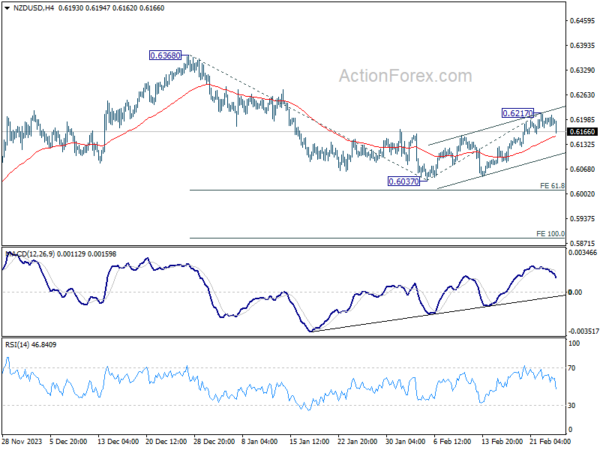

Technically, with today’s decline, immediate focus for NZD/USD is now on 55 4H EMA (now at 0.6153). Sustained break there will argue that the rebound from 0.6037 has completed as a three-wave corrective move to 0.6217. In this case, NZD/USD could be ready to resume the fall from 0.6368 through 0.6037 to 61.8% projection of 0.6368 to 0.6037 from 0.6217 at 0.6012 next.

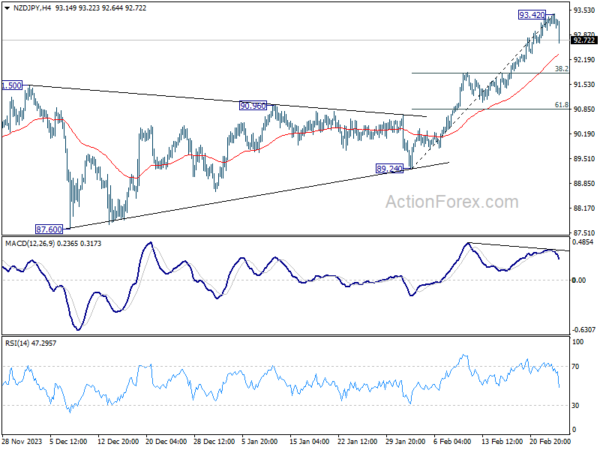

Bearish divergence condition in 4H MACD argues that a short term top was already formed at 93.42 in NZD/JPY. Risk will now stay on the downside as long as 93.42 holds. Deeper fall would be seen to 55 4H EMA (now at 92.31) and below. But for now, considering the overall weakness in Yen, downside should be contained by 38.2% retracement of 89.24 to 93.42 at 91.82 to bring rebound.