Crypto markets firmed after US President Donald Trump signed an executive order aimed at broadening investment options in retirement accounts. The policy change clears a path for cryptocurrencies, private equity, and real estate to be included in 401(k) plans, potentially diverting large-scale institutional capital into the digital asset space.

The USD 12 trillion defined contribution market has largely avoided exposure to alternative assets. Trump’s order seeks to reverse that by reducing litigation exposure and regulatory complexity for fund managers. “My Administration will relieve the regulatory burdens and litigation risk that impede American workers’ retirement accounts from achieving competitive returns,” Trump stated. Industry participants see this as a long-awaited greenlight to diversify away from traditional stocks and bonds.

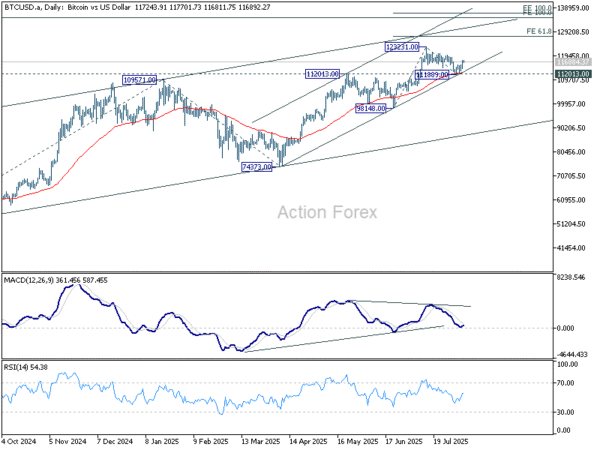

Bitcoin bounces this week but stays well below 123,231 resistance. Near term consolidations could extend. But outlook remains bearish so far with a confluence of support intact, including 112,013 resistance turned support, 55 D EMA, and near term rising channel. Current up trend is expected to resume to 61.8% projection of 98,148 to 123,231 from 111,889 at 127,390 next.

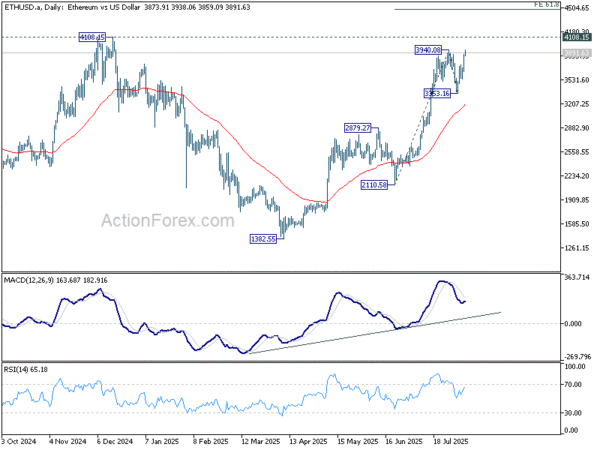

Ethereum’s breach of 3,940.08 resistance suggests that recent rally from 1,382.55 is resuming. Next target is 4,108.15 key resistance. Firm break there will target 61.8% projection of 2,110.58 to 3,940.08 from 3,353.16 at 4,483.19 next. In case of retreat, outlook will stay bullish as long as 3,353.16 support holds.