Euro drops sharply as markets are disappointed that ECB account of March monetary policy meeting delivers no hawkishness at all. EUR weakens against all but JPY and CHF as seen in the current 4H heatmap.

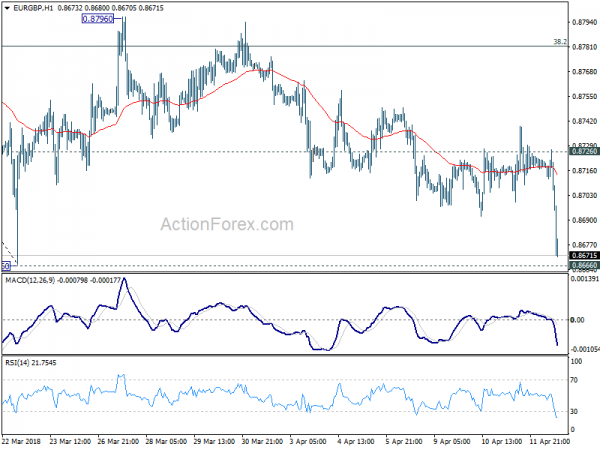

In particular, the sharp decline in EUR/GBP is now setting it up for a test on 0.8666 key support.

Regarding inflation, ECB noted that “measures of underlying inflation remained subdued and had yet to show convincing signs of a sustained upward trend.” And, “ample degree of monetary policy accommodation remained necessary to accompany the economic expansion and for price pressures to continue to build up”. Also, “remaining uncertainties and muted underlying inflation pressures called for caution and underlined the need to maintain the prevailing policy posture of prudence, patience and persistence.”

The removal of easing bias on regarding the asset purchase program from the forward guidance was justified because “economic expansion had become more robust and scenarios of large negative economic surprises, leading to renewed deflationary risks, had become less likely.” Still, the Governing Council members emphasized the “prudence, patience and persistence remained warranted and the key elements of the Governing Council’s forward guidance on policy rates and the APP needed to be confirmed, including the open-endedness of the APP.

Regarding Euro’s exchange rate, ECB noted that “recent movements in the euro exchange rate seemed to relate more to the relative monetary policy shocks, including communication, and less to improvements in the macroeconomic outlook.” And, “this suggested that the exchange rate appreciation could be expected to have a more negative impact on inflation.”

ECB also warned that “there was widespread concern that the risk of trade conflicts, which could be expected to have an adverse impact on activity for all countries involved, had increased.” ECB added,”it was also cautioned that negative confidence effects could arise.”