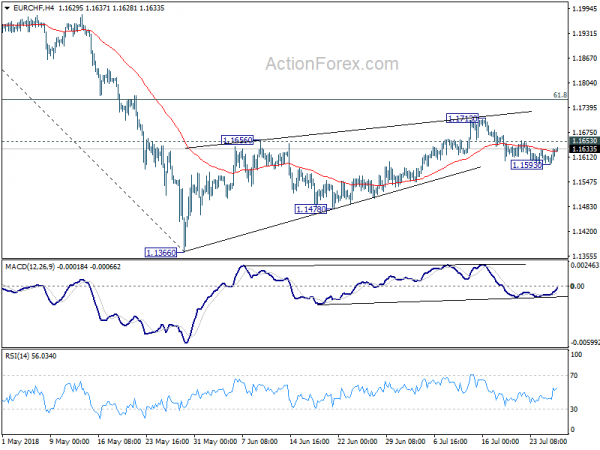

Daily Pivots: (S1) 1.1605; (P) 1.1621; (R1) 1.1646; More…

Intraday bias in EUR/CHF is turned neutral with current recovery. But another fall is still in favor with 1.1653 minor resistance intact. We’re holding on to the view that corrective rebound from 1.1366 has completed with three waves up to 1.1713 already. Below 1.1593 will target 1.1478 support to confirm this case. However, above 1.1653 minor resistance will bring another rise. But in that case, we’d expect strong resistance from 61.8% retracement of 1.2004 to 1.1366 at 1.1760 to bring near term reversal.

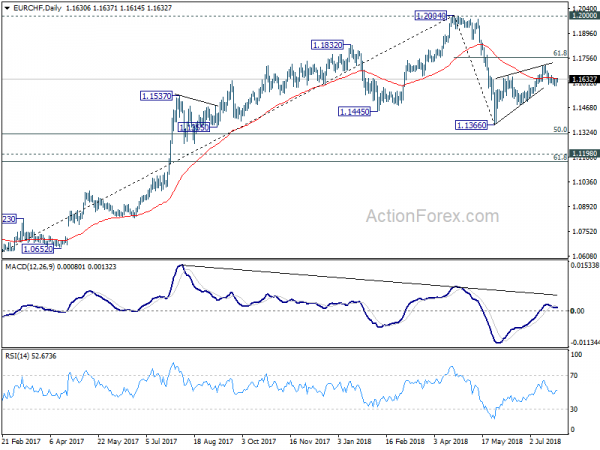

In the bigger picture, 1.2004 is seen as a medium term top with bearish divergence condition in daily and weekly MACD. 1.2000 is also an important resistance level. Hence, the corrective pattern from 1.2004 is expected to extend for a while before completion. We’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.