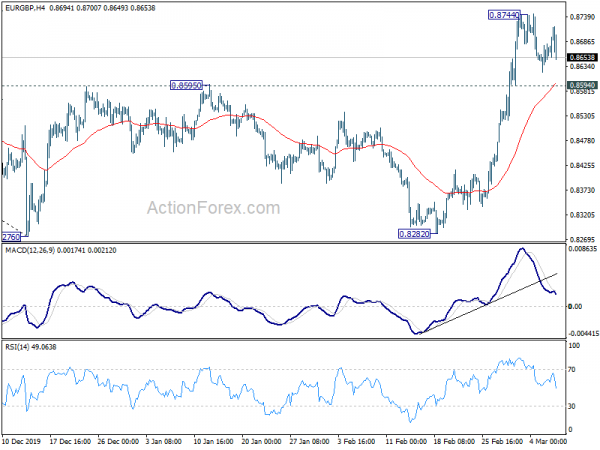

EUR/GBP rose further to 0.8744 last week but retreated since then. Initial bias remains neutral this week first. At this point, we’re still viewing price actions from 0.8276 as a corrective pattern. Hence, in case of another rise, we’d expect strong resistance from 0.8786 resistance to limit upside. Break of 0.8594 support will turn bias back to the downside for retesting 0.8276 low. However, sustained break of 0.8786 will indicate near term bullishness for 61.8% retracement of 0.9324 to 0.8276 at 0.8924 next.

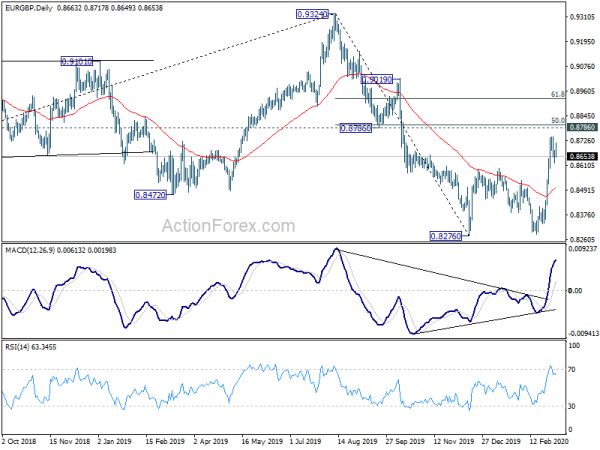

In the bigger picture, there are various interpretations on the price actions from 0.9324. It could be the third leg of the pattern from 0.9799 (2008 high). Or it could just be correcting the rise from 0.6935 (2015 low) to 0.9324. But in any case, as long as 0.8786 support turned resistance holds, further decline is expected to 61.8% retracement of 0.6935 to 0.9324 at 0.7848 next. Firm break of 0.8786, however, will bring retest of 0.9324 high.

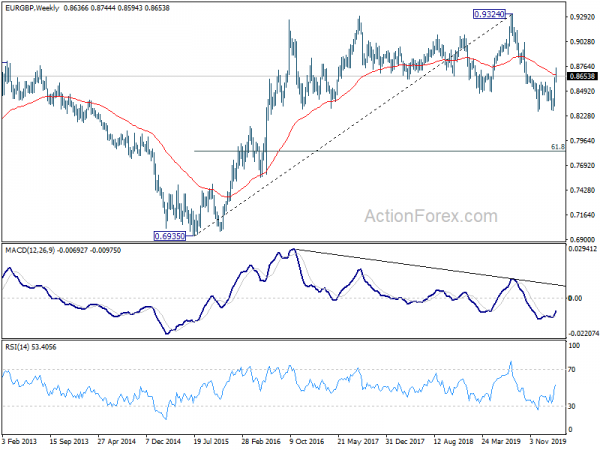

In the long term picture, fall from 0.9324 is currently seen as the third leg of the whole pattern from 0.9799 (2008 high). It’s a bit early to judge how deep the decline would extend to and whether 0.6935 would be taken out. We’ll pay attention to the structure of the fall from 0.9324 and corresponding downside momentum to made an assessment later.