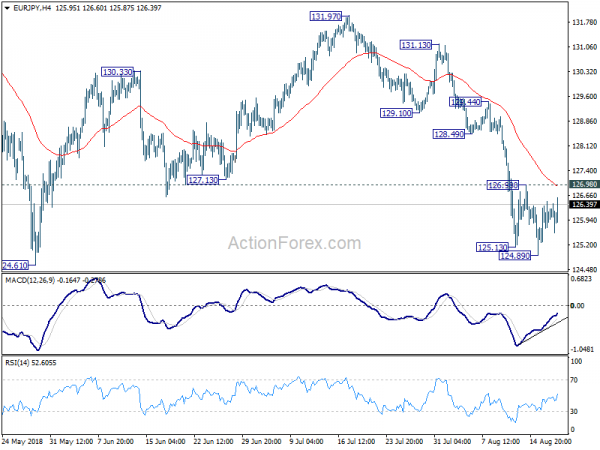

EUR/JPY dropped to as low as 124.89 last week but lost momentum and turned sideway ahead of 124.61 low. Initial bias is neutral this week first. As long as 126.98 minor resistance holds, deeper fall could still be seen. But considering mild bullish convergence condition in 4 hour MACD, downside should be contained by 124.08/61 key support zone to bring rebound. On the upside, break of 126.98 will indicate short term bottoming and turn bias back to upside for stronger rebound.

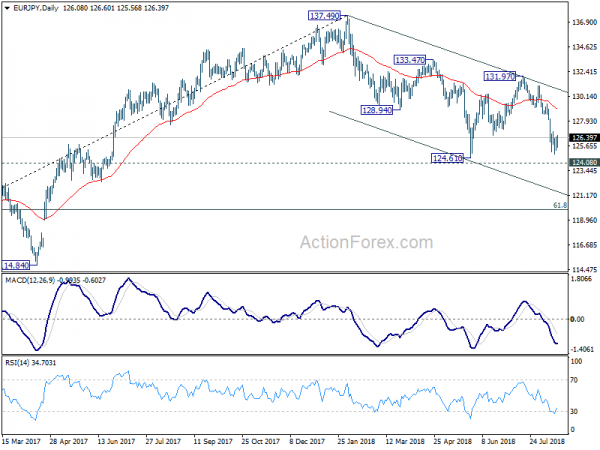

In the bigger picture, focus is back on 124.08 key resistance turned support. Decisive break there will argue that whole rise from 109.03 (2016 low) has completed at 137.49. Deeper decline would be seen to 61.8% retracement of 109.03 to 137.49 at 119.90 next. Sustained break there will pave the way to 109.03 and below. Meanwhile, rebound from 124.08 will keep medium term bullishness intact for another high above 137.49.

In the long term picture, at this point, EUR/JPY is staying in long term sideway pattern, established since 2000. Rise from 109.03 is seen as a leg inside the pattern. As long as 124.08 support holds, further rally is in favor in medium to long term through 149.76 high. However, break of 124.08 could extend the fall through 109.03 low instead.