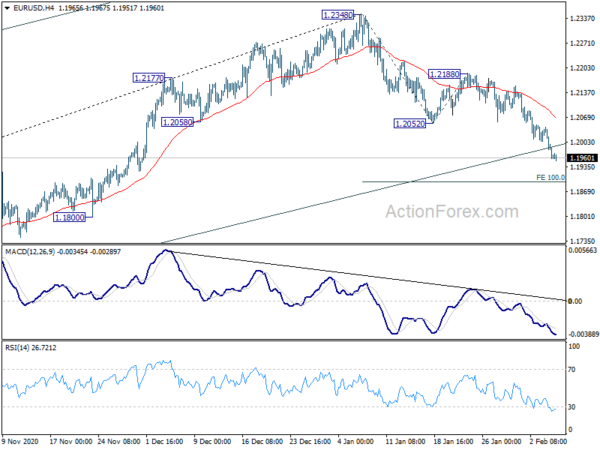

Daily Pivots: (S1) 1.1932; (P) 1.1988; (R1) 1.2017; More…

EUR/USD’s decline extends to as low as 1.1951 so far. The break of channel support suggests that fall from 1.2348 is correcting whole up trend from 1.0635. Intraday bias stays on the downside for 100% projection of 1.2348 to 1.2052 from 1.2188 at 1.1892 first. Break will target 38.2% retracement of 1.0635 to 1.2348 at 1.1694. For now, risk will stay on the downside as long as 1.2052 support turned resistance holds, in case of recovery.

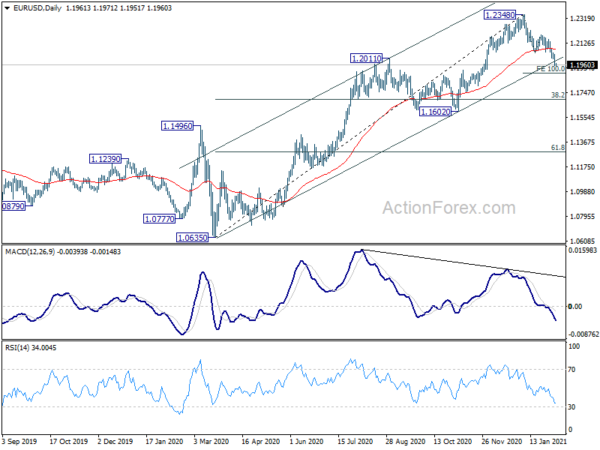

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.