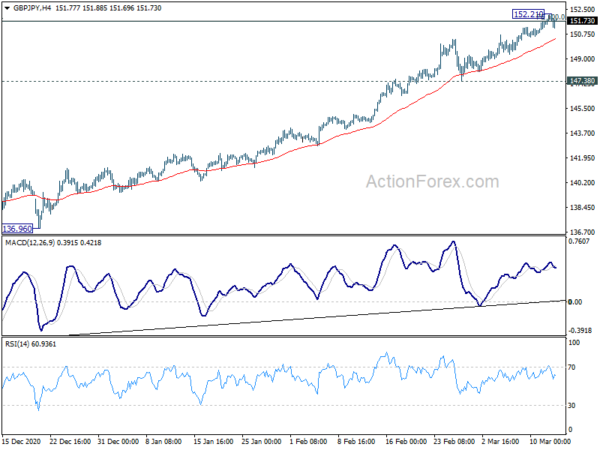

GBP/JPY’s up trend continued last week but lost momentum after hitting 152.21. Initial bias is turned neutral first. The cross is now pressing 100% projection of 123.94 to 142.71 from 133.03 at 151.80 next and channel resistance. Break of 147.38 support will indicate short term topping and turn bias to the downside for correction. Nevertheless, sustained trading above 151.80 will indicate upside acceleration. Next target is key resistance at 156.59.

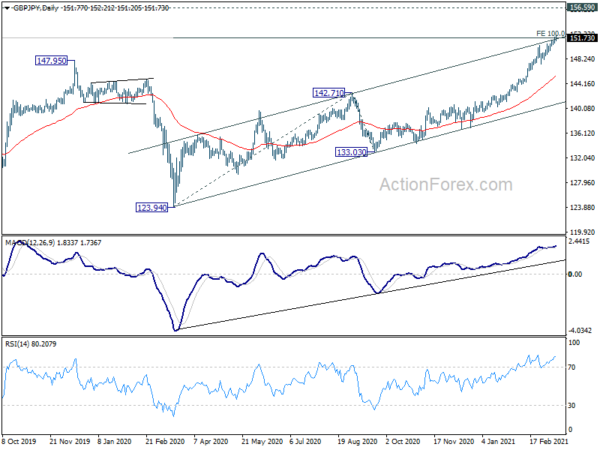

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Next target is 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. On the downside, break of 142.71 resistance turned support is needed to be the first sign of completion of the rise from 123.94. Otherwise, outlook will remain bullish even in case of deep pull back.

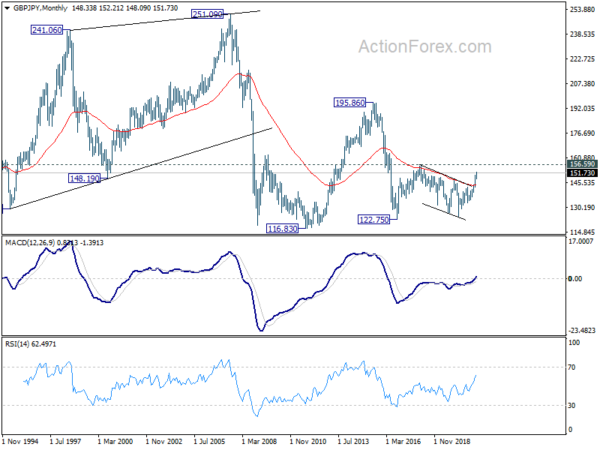

In the longer term picture, the strong break of 55 months EMA (now at 143.95) is a early sign of long term bullish reversal. Firm break of 156.69 resistance should now confirm the start of an up trend for 195.86 (2015 high).