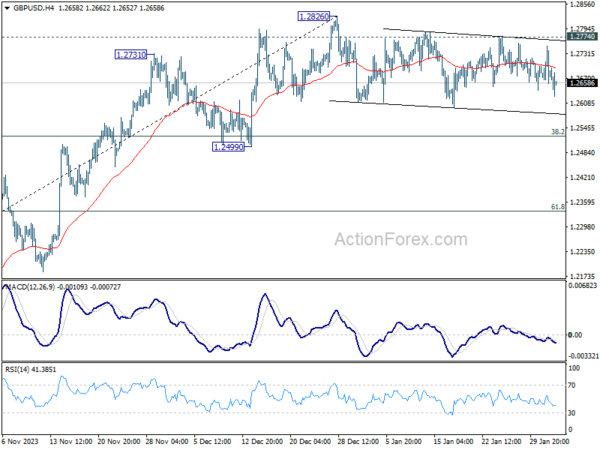

Daily Pivots: (S1) 1.2646; (P) 1.2699; (R1) 1.2739; More…

No change in GBP/USD’s outlook and intraday bias remains neutral. Consolidation from 1.2826 is extending and deeper fall cannot be ruled out. But downside should be contained above 1.2499 support to bring rebound. On the upside, firm break of 1.2774 resistance will suggest that consolidation pattern has completed. Further rise should be seen through 1.2826 to resume the rally from 1.2036. Next target will be 1.3141 high.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.