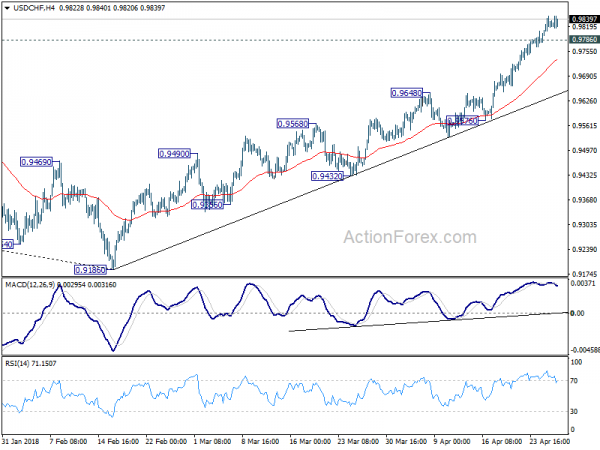

Daily Pivots: (S1) 0.9792; (P) 0.9819; (R1) 0.9859; More…

Despite diminishing upside momentum as see in 4 hour MACD, there is no sign of retreat yet. Intraday bias in USD/CHF remains on the upside for 0.9900 fibonacci level first. Break will target 1.0037 resistance next. On the downside, below 0.9786 minor support will turn bias neutral and bring consolidations. But outlook will stay bullish as long as 0.9576 support holds.

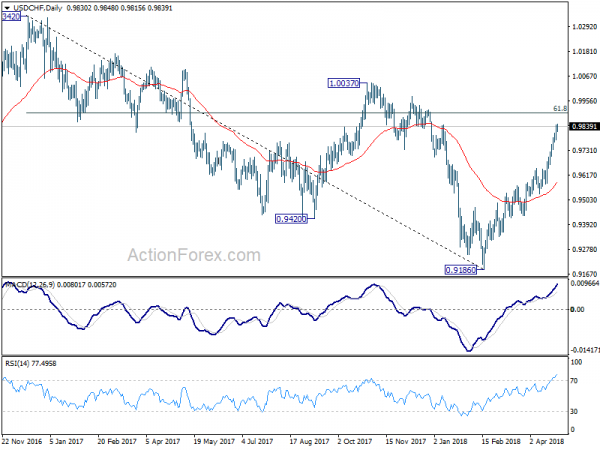

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. The break of 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626 suggests that it’s likely completed at 0.9186 already. Further rally would be seen back to 61.8% retracement at 0.9900 and above. Sustained break there would pave the way to retest 1.0342 key resistance next. This will now be the preferred case as long as 0.9576 support holds.