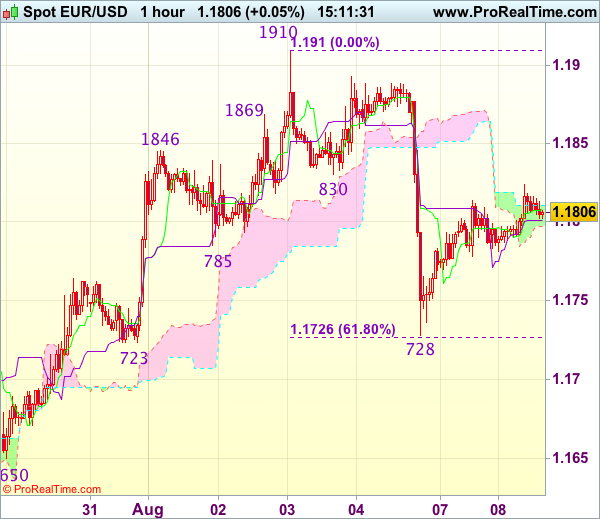

EUR/USD – 1.1815

Most recent candlesticks pattern : N/A

Trend : Near term up

Tenkan-Sen level : 1.1808

Kijun-Sen level : 1.1801

Ichimoku cloud top : 1.1811

Ichimoku cloud bottom : 1.1797

Original strategy :

Sell at 1.1830, Target: 1.1730, Stop: 1.1865

Position : –

Target : –

Stop : –

New strategy :

Sell at 1.1840, Target: 1.1740, Stop: 1.1875

Position : –

Target : –

Stop : –

As the single currency edged higher after brief pullback, suggesting near term upside risk remains for the rebound from 1.1728 to extend gain to previous support at 1.1830, however, if our view that top has been formed at 1.1910 is correct, upside should be limited to 1.1850 and bring retreat later, below .1775-0 would suggest an intra-day top is formed, bring weakness to 1.1750, then retest of 1.1723-28 (previous support as well as 61.8% Fibonacci retracement of 1.1613-1.1910), break there would add credence to our view that top has been formed at 1.1910 last week, bring further fall to 1.1700 but reckon support at 1.1650 would remain intact.

In view of this, we are looking to sell euro again on further recovery as 1.1830 previous support should limit upside. Above 1.1855-60 would defer and risk a stronger rebound to 1.1875-80 but price should falter below said last week’s high at 1.1910, bring another decline later.