Daily Pivots: (S1) 1.2934; (P) 1.2967; (R1) 1.3007; More…

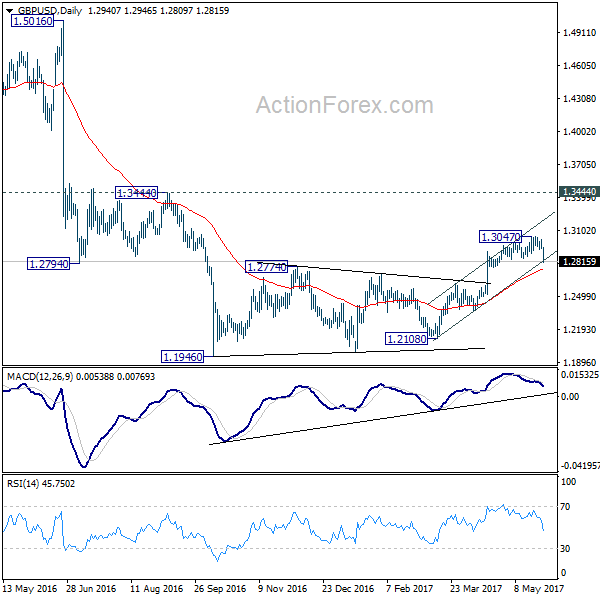

GBP/USD’s fall from 1.3047 accelerates to as low as 1.2809 and broke 1.2844 support. The development, and the break of near term channel support, suggest reversal in the pair. That is, the rise from 1.2108 could be finished at 1.3047 already. Intraday bias is turned back to the downside for 1.2614 resistance turned support. Also, noted again that we are still viewing price actions from 1.1946 as a corrective move. Break of 1.2614 will indicate that such correction is finished too and the larger downtrend is is resuming for new low below 1.1946. This will be the mildly preferred case now as long as 1.3047 resistance holds.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There are signs of reversal, like breaking of 55 week EMA, weekly MACD turned positive, and monthly MACD crossed above signal line. But still, break of 1.3444 resistance is need to confirm medium term bottoming. Otherwise, outlook will remains bearish for extend the down trend through 1.1946 low.