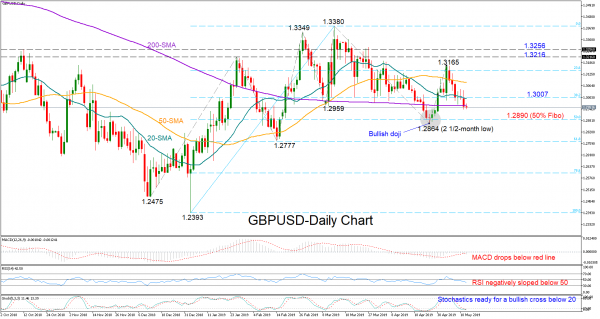

GBPUSD extended last week’s decline towards the 200-day simple moving average (SMA) on Monday and could lose further if the RSI and the MACD remain in bearish territory. The fast-stochastic oscillator, however, suggests that in the very short-term upside corrections are possible as the indicator heads for a bullish cross in oversold area.

The previous low of 1.2864 (bullish doji), which is slightly below the 50% Fibonacci of the upleg from 1.2393 to 1.3380, will be closely watched in case of additional bearish sessions as any break lower would return confidence to the downleg started from the 1.3380 peak. Further down, the next key support could be detected around the 61.8% Fibonacci and the February low of 1.2777.

Should the price jump above the 1.30 mark and the 20-day SMA, gains could last until the 50-day SMA currently at 1.3082. Moving higher, a decisive close above this month top of 1.3165 could drive the price up to the 1.3216-1.3256 area. If the market manages to overcome the latter, more buying may follow.

In the medium-term picture, the outlook remains neutral as long as the price fluctuates within the 1.2777-1.3380 area. The flattening 50- and the 200-day SMAs signal that an outlook reversal may not happen soon.