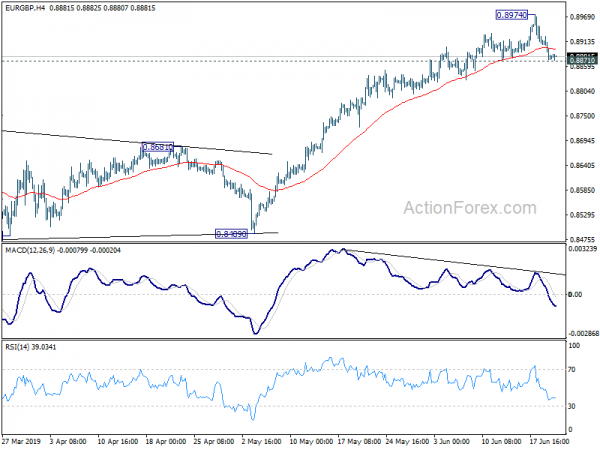

Daily Pivots: (S1) 0.8860; (P) 0.8894; (R1) 0.8914; More…

Intraday bias in EUR/GBP remains neutral for the moment and some consolidations could be seen. Though, further rise is expected as long as 0.8871 minor support holds. Above 0.8974 will target 0.9101 key resistance next. However, considering bearish divergence condition in 4 hour MACD, break of 0.8871 minor support will indicate short term topping and bring deeper pull back towards 55 day EMA (now at 0.8772).

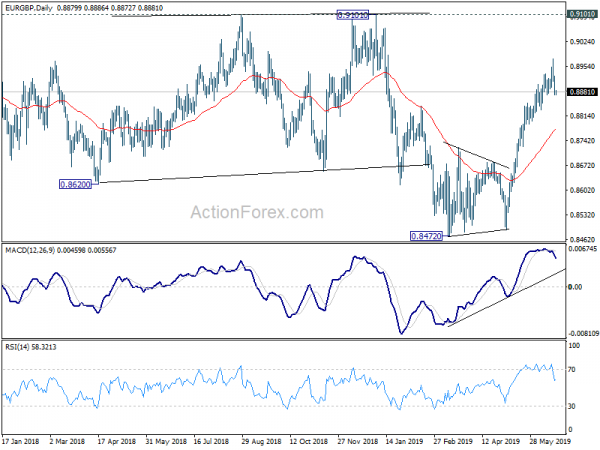

In the bigger picture, medium term decline from 0.9305 (2017 high) is seen as a corrective move. No change in this view. Current development argues that it might have completed with three waves down to 0.8472, just ahead of 38.2% retracement of 0.6935 (2015 low) to 0.9306 at 0.8400, after hitting 55 month EMA (now at 0.8527). Decisive break of 0.9101 resistance will confirm this bullish case. Nevertheless, as EUR/GBP is still staying inside long term falling channel, correction from 0.9305 could still extend to 0.8400 fibonacci level before completion, if upside is rejected by 0.9101.