- We expect the ECB to leave the deposit unchanged at 2.00% on Thursday 24 July in line with consensus and market pricing. We expect Lagarde to reiterate the data dependent approach and leave the door open for September, without giving firm signals as data has been limited.

- We expect a final 25bp cut to 1.75% in September due to a weakening services sector, slowing wage growth and elevated trade uncertainty though risks lean towards no cut as ECB members emphasize their “good position” and downplay inflation undershooting concerns.

We expect the ECB to keep the deposit rate unchanged at 2.00% on Thursday 24 July in line with consensus and market pricing. The hawkish shift at the June meeting has removed expectations for a cut in July. Focus next week will be on any signals about the September meeting where markets currently price 10bp worth of cuts. ECB communication has been very unanimous since the June meeting and most GC members have echoed that ECB is in a ‘good position’, while Schnabel (hawk) said that the bar for another cut is very high. The ECB has been downplaying the fact that inflation is expected to temporally undershoot the 2% target as long as medium-term inflation expectations are anchored. The June meeting minutes stated a view that monetary policy ‘should become less reactive to incoming data’ and ‘only large shocks would imply the need for a monetary response’. Hence, we expect no cut at the July meeting while projecting a final cut in September to 1.75% with risks tilted towards an unchanged decision.

We continue to project a cut in September given the trade war risk, a weakening services sector and slowing wage growth that could impact medium-term inflation expectations. The outcome of the tariff negotiations will be important for monetary policy setting going forward as tariffs higher than 10% on the EU would deviate from the ECB’s baseline assumptions. Lately, the risk of a larger 30% tariff has increased, which argues for further easing. We expect the trade war uncertainty to lead Lagarde to reiterate that the ECB is data dependent, thereby not precommitting or closing the door for a cut in September as they await further data.

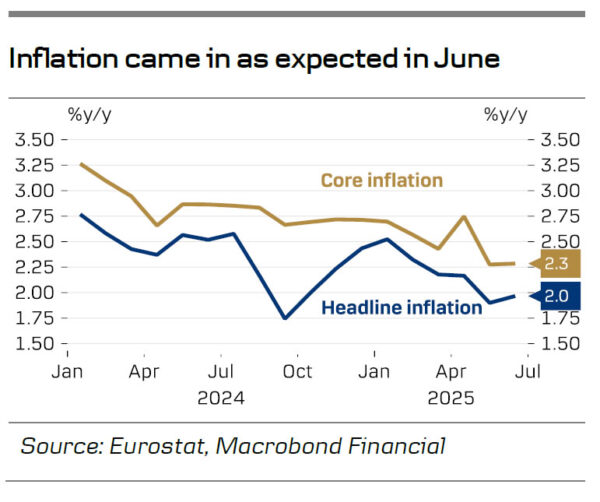

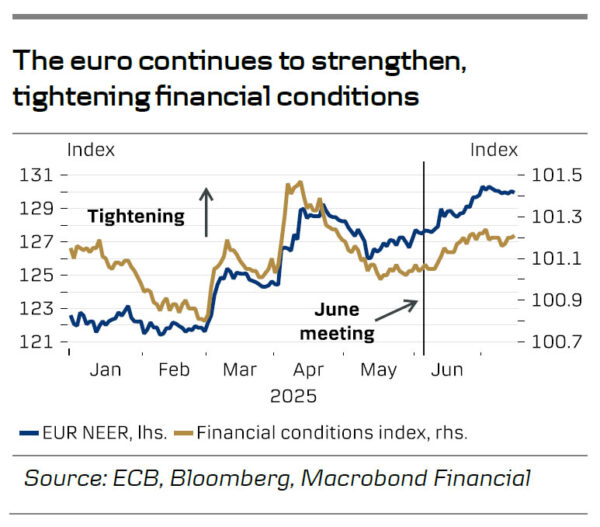

Incoming data since the June meeting has been very limited and has likely not changed the ECB’s view. We have only received one tier-1 data print, June inflation, which rose as expected to 2.0% due to energy base effects while core inflation remained at 2.3%, the latter due to a continued high momentum in services inflation. Industrial production in May rose more than expected like the German ZEW in July. Hence, data has been marginally hawkish. Market inflation expectations have also risen slightly, while financial conditions on the other hand have tightened due to rising long-term yields and the strengthening of the euro. We expect Lagarde to receive questions about the strengthening euro but downplay what it means for the ECB, although the dove camp seems more concerned about the impact on exports. By September two additional inflation prints and one PMI, the Q2 compensation per employee data and new staff projections, should make Lagarde leave the September decision open. Hence, ECB is most likely satisfied with the current market pricing, and we expect Lagarde to aim for a limited market reaction.