Oil prices have risen at the start of the week after the Organization of the Petroleum Exporting Countries and its allies (OPEC +) once again delivered what I would call a strategic under-delivery of the expected output hike.

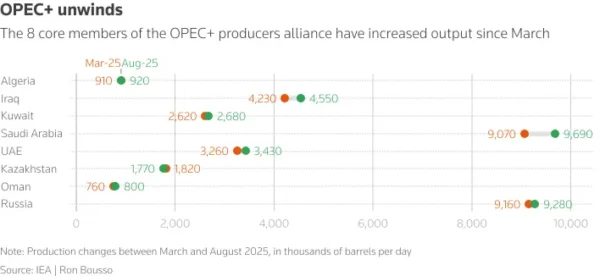

OPEC+ announced a modest production increase following their recent meeting, agreeing to raise output by 137,000 barrels per day (bpd).

Source: LSEG

What Does the OPEC + Decision Tell Us?

The rise in production may be a signal that OPEC + cares more about keeping supply tight than grabbing extra market share or making oil cheaper for buyers.

I for one had been of the school of thought that the increases were partly down to a desire by the group to gain more market share. However, I am beginning to doubt my own narrative.

A bump of about 137,000 barrels per day may seem almost nothing in a world that moves millions, yet it holds some psychological weight.

It may be read as a small give‑in to political and market pressure while therefore holding members to a disciplined output plan.

By choosing a lift below what many expected, OPEC+ probably tried to dodge a sudden plunge a supply surge could cause.

Moreover, this defensive stance suggests a stable price floor remains especially crucial for budget health for the member economies.

Decoding the Price Action: A Rally Based on Relief, Not Demand Strength

Brent crude settled a little above the $65 per barrel line, around $65.30, a level many traders watch as a mental barrier. This jump in price is similar to the one we saw after the last OPEC + meeting, but more from a sigh of relief in the market.

Market participants’ worries about a “big rise” in supply appear to have eased after the group announced its output decision. The less than expected output increase may have led some to cover short exposure to Oil prices which could in part be behind the rally. The rally was nonetheless welcomed after last week’s 8% decline.

Navigating a Potential Structural Surplus Moving Forward

While OPEC+ successfully managed short-term price volatility, the longer-term outlook remains shadowed by significant structural bearishness. Market sentiment continues to be fundamentally weighed down by “ongoing concerns about oversupply projected into 2026”.

That worry comes mostly from big rises in non‑OPEC output, like the surge in US shale rigs in Texas and new offshore wells off Brazil. Those sources sit outside the cartel’s cap system, so OPEC+ ends up fighting a tactical cut war while the rest of the world keeps adding barrels.

The International Energy Agency tossed out a figure that a record surplus could show up in 2026. If that number sticks, it backs the idea that growth in oil production will beat demand.

Prices have slipped year‑to‑date, and a bigger surplus could push them even lower. That would leave OPEC+ with little room to breathe. They may need to carve deep cuts, hurting their own members, to stop prices from falling below the target zones. Yet, some claim a softer approach, hoping demand‑side shifts could balance things out.

Technical Analysis – Brent Crude

From a technical analysis standpoint, Brent Crude is back above the $65/barrel mark with upside likely to remain limited.

There is a host of hurdles just ahead of current price with the 20,50 and 100-day MAs all resting between the 66.71 and 67.58 handle.

This confluence zone may prove a tough nut to crack and may cap any attempt at a move higher for Oil prices.

Looking at the downside, immediate support below the 65.00 handle may be found at the swing low printed on May 30 which rests at 62.60.

Below that, the next key point of interest will be the psychological 60.00 mark which could offer support should price reach those levels.

Brent Crude Oil Daily Chart, October 6, 2025

Source: TradingView (click to enlarge)