Canadian Highlights

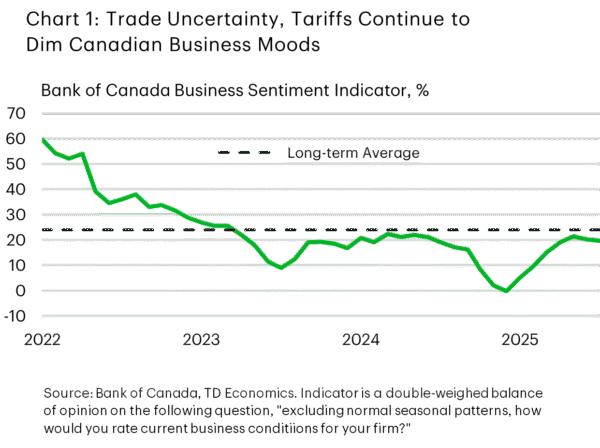

- The Bank of Canada’s business and consumer sentiment surveys continued to point to subdued moods amid economic uncertainty.

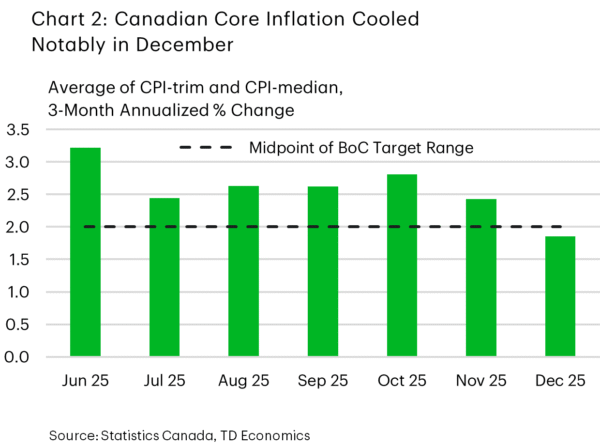

- Cooling core inflation metrics in December 2025 were likely well received by policymakers, even with an acceleration in overall inflation.

- Even with the headwind of uncertainty, Canadian consumer spending is holding up, with November retail trade volumes up 1% month-on-month.

U.S. Highlights

- Financial markets declined sharply on rising trade and geopolitical tensions but clawed earlier losses as cooler heads prevailed at the World Economic Forum in Davos.

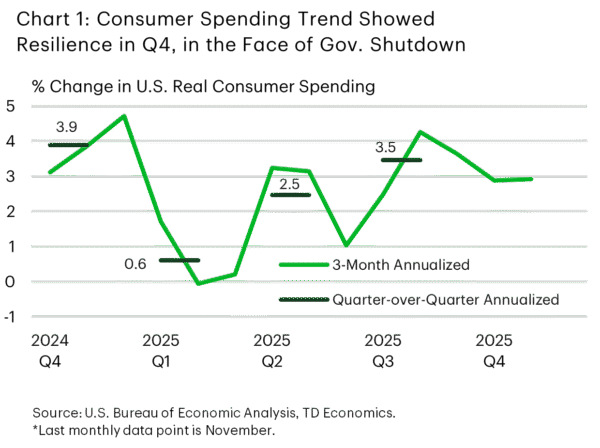

- Consumer resilience carried into the fourth quarter, despite around 650,000 federal workers being furloughed without pay throughout the six-week long government shutdown.

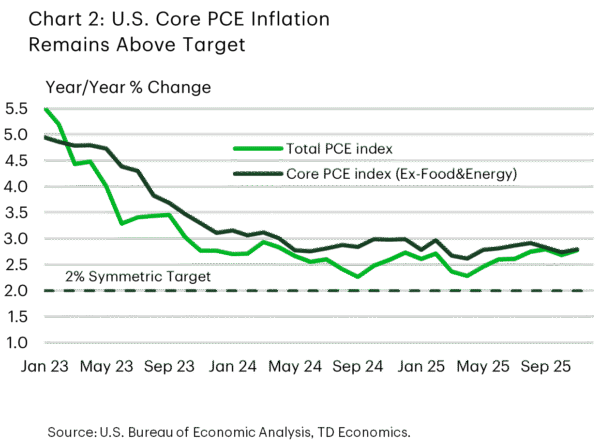

- Core PCE inflation rose to 2.8% year-over-year in November, a light acceleration form 2.7% in October.

Canada – Transatlantic Tensions Unsettle Markets

For financial markets this week, an appropriate statement may have been “what a year this week was”. The TSX, for instance, plunged early in the week on tensions between Europe and the U.S. over Greenland. It then staged a relief rally, more-than-fully recouping those losses after President Trump eased fears of military action in the region and a renewed trade war with Europe. Canadian bond yields were also volatile, flaring higher alongside the spike in Japanese bond yields and geopolitical tensions, before pulling back a touch, as cooler heads prevailed on the Greenland issue.

These events reinforced that Canada continues to deal in an uncertain economic backdrop, and this will likely be a factor restraining economic activity in 2026. This uneasiness has certainly been weighing on consumer and business moods, and we received fresh evidence of this impact this week with the latest Bank of Canada surveys on business and consumer confidence. Although showing some improvement relative to early 2025, business sentiment continues to be “subdued” (Chart 1). The uncertainty caused by the trade war continues to weigh on investment intentions, consistent with the pullback that we are seeing in the hard data. Consumers are also concerned about trade uncertainty, though actual spending remains decent. This week’s retail spending report showed a healthy 1% monthly gain in volumes. And, although retail sales are tracking flat for Q4 overall, we see some upside risk to our fourth quarter consumption forecast, on the back of stronger services spending.

High prices were also a top concern for consumers in the Bank’s latest survey. However, there was some good news on this front this week. The Bank’s preferred core inflation metrics cooled in December (Chart 2), with the 3-month annualized percent change for the CPI-trim and CPI-median both ducking under 2%. What’s more, the share of items whose prices grew at 3% or more dropped (when measured on the same basis) – signaling a narrowing breadth of inflation across categories. However, the report wasn’t a complete slam dunk, as overall inflation increased by more than expected on the back of stronger food prices.

Tying these threads together, this week painted a picture of a soft underlying Canadian economy with moderating inflation pressures that still faces significant uncertainty. While this was enough for markets to slightly pare back their expectations of a rate hike later this year, we don’t think it was enough to meaningfully shift the policy dial. The Bank has repeatedly said that they are happy with the current policy stance, provided the economy evolves broadly in line with expectations. And, at 2.8%, core inflation landed almost bang-on the Bank’s expectation for 2025Q4. Indeed, it would take a significant undershooting of economic growth or meaningful softening in the labour market to force policymakers off the sidelines.

U.S. – Davos De-escalation Supports Market Recovery

Financial markets experienced considerable volatility this week amid resurgent geopolitical and trade frictions. President Trump ramped up the pressure to ‘acquire’ Greenland ahead of the annual World Economic Forum in Davos. He announced tariffs on eight European countries that resisted these efforts. This set into motion retaliatory efforts, with the EU suspending the ratification of the U.S.-EU trade agreement. Global financial markets fell sharply, as did the trade-weighted U.S. dollar and Treasury prices. Relief emerged during the Davos meetings. During his speech, President Trump ruled out military action on Greenland. He subsequently announced that a “framework on a future deal” had been reached and dropped earlier tariff threats. Markets responded strongly, with the S&P 500 recovering nearly all its intra-week declines.

Stepping back from market swings, the episode reveals deeper geopolitical and economic implications. While tensions have eased, significant uncertainties remain. Details on the proposed framework on Greenland are limited, appearing to center on mineral rights extraction and potential integration into the planned Golden Dome missile defense system. Denmark and its allies firmly oppose any outcome that compromises territorial sovereignty, raising the risk of future bouts of escalation. Additionally, this week’s events bring into question the stability of the trade deals that have been negotiated thus far. The sudden announcement of tariff threats undermined recently negotiated agreements with the U.K. and the EU, chipping away at the predictability these pacts were meant to secure. Such policy volatility undermines business and investor confidence, which underpins forecasts for improved U.S. growth in 2026.

A light U.S. economic data calendar took a backseat to Greenland developments, yet the released figures highlighted resilience. The first revision to third-quarter GDP lifted annualized growth to 4.4% from 4.3%, reflecting upward adjustments in exports and business fixed investment. Consumer spending remained unchanged at 3.5%, but the trend in the fourth quarter appeared to remain healthy. The delayed October and November PCE reports pointed to greater household endurance through the extended government shutdown than initially anticipated (Chart 1). This recent data brings our tracking for consumption in the fourth quarter to 3% – stronger than previously expected. Inflation, however, tempered the positive tone. Core PCE inflation – the Fed’s preferred inflation gauge – rose to 2.8% year-over-year in November from 2.7% in October, remaining firmly above the 2% target (Chart 2).

Overall, the U.S. economy enters 2026 on firmer ground than previously expected, bolstered by upward growth revisions and a resilient consumer. Yet this week’s swift escalation and de-escalation raise a fundamental question: can trade agreements be considered truly settled when they remain vulnerable to unilateral changes? Trade frictions – previously expected to fade and support growth – may persist longer than anticipated, with this week’s events a clear reminder of that.