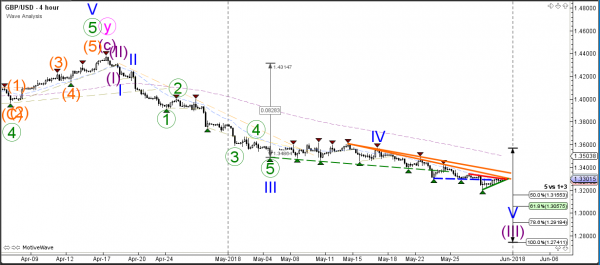

The GBP/USD remains in a downtrend as long as price stays below the resistance trend lines. A bearish breakout below the support trend line (green) could indicate a potential continuation towards the Fibonacci targets of wave 5. A bullish retracement could occur above the resistance trend lines or at the Fib targets for either a wave 4 (purple) or wave 2 (if the current downtrend completes a wave 1 rather than wave 3).

The GBP/USD ending diagonal pattern could be valid but only if the GBP/USD retraces back to and bounces at the 61.8%-78.6% Fibonacci retracement zone of wave 4 (green). A bearish bounce at a shallower Fibonacci levels would indicate a bearish impulse. In both cases, price needs to break below the support trend line (green) to continue with the downtrend towards the Fibonacci targets . A break above the 78.6% Fib could indicate the end of the downtrend.