Safe haven flow is the main theme today as markets await G6+1 showdown in Canada. Yen is the biggest winner today, followed by Dollar. But these two remain the weakest ones for the week next to Canadian Dollar. Despite weaker than expected job data, CAD is indeed rather steady in early US session. The main moves in the forex markets are likely driven by treasury yields. German 10 year bund yield is dropping -0.036 at the time of writing, trading below 0.45 handle. Italian 10 year yield rises 0.068 to 3.061. That is, German-Italian spread is back above 250. Adding to that, European indices open the day generally lower. Despite paring much losses, DAX is still down -0.4%. US futures are also pointing to slightly lower open.

Confrontations are expected to continue between the US and others on trade issue, at the G6+1 summit in Canada, today and tomorrow. Ahead of the meeting, Trump pledged, with his tweets to, straightening out unfair trade deals with G7 countries. Facing pressure from Germany, France and Canada, Trump will continue with his confrontational approach. Yet, Trump will leave earlier than anticipated, right after Saturday’s morning session, on June 9. Then he will fly straight to Singapore for the highly anticipated Kim-Trump summit on June 12.

On the data front, Canada employment dropped -7.5k in May, below expectation of 19.1k growth. Unemployment rate was unchanged at 5.8%. Housing starts dropped to 196k in May, below expectation of 217k. German trade surplus narrowed to EUR 19.4b in April, industrial production dropped -1.0% mom. China trade deficit narrowed to USD 24.9B in May, below expectation of USD 32.5B. Japan Q1 GDP was finalized at -0.2% qoq, unrevised. GDP deflator was finalized at 0.5% yoy. Current account surplus widened to JPY 1.89T in April.

UK Hammond: Collaborative approach is generally more productive than a confrontational approach

UK Chancellor of Exchequer Philip Hammond said today that a “collaborative approach… is generally more productive than a confrontational approach, in dealing with Germans French and Italians. And, for a better Brexit deal, Hammond said it’s important to engage the partners. He added that “finding a mutually beneficial outcome is the only way forward. That is the firm intention of my government. Theresa May, the prime minister, has said so very clearly.”

That was in response to a recording of Foreign Minister Boris Johnson on Brexit approach, published by Buzzfeed. Johnson said “imagine Trump doing Brexit,” “there’d be all sorts of breakdowns, all sorts of chaos. Everyone would think he’d gone mad. But actually you might get somewhere. It’s a very, very good thought.”

Prime Minister Theresa May’s spokesman said that May “of course” still have confidence in John. And, “the PM believes that her cabinet and her government are working hard to deliver on the will of the people and working hard to take back control of our money, laws and our borders.”

Japan automakers slam Trump’s tariffs as Abe kept silence

Japan Prime Minister Shinzo Abe has been so far very quiet regarding trade tensions with the US. Abe and his cabinet members have repeatedly said that they do not want bilateral trade agreements. But Trump is insisting to force Japan into it. And that’s not to mention that Japan was the only close ally that was not even given a temporary exemption on the steel and aluminum tariffs. It’s even unsure what retaliation they’ll take. The meeting between Abe and Trump ahead of G6+1 submit also produced no progress on trade.

But back in his homeland, Abe is facing increasing pressure on him to take a stance. The Japan Automobile Manufacturers Association issued a statement today slamming the US probe of automobile imports using national security as excuse again. In the statement, JAMA expressed “gravely concerned” of the investigation. It emphasized that “automobiles are sold to consumers on the basis of their own choices, and it is consumers themselves who would be penalized, through increased vehicle prices and reduced model options”. Additionally, “business plans of automobile and auto parts manufacturers as well as imported vehicle dealers could be seriously disrupted, with potentially adverse impacts on the U.S. economy and jobs.”

JAMA also pointed to “facts” that their member companies operate “24 manufacturing plants and 44 R&D/design centers in 19 U.S. states and in 2017, nearly 3.8 million vehicles were produced by American workers at those facilities.” “Of that total, over 420,000 units were exported to countries around the world, further underscoring our contributions to employment and economic growth in the United States.”

JAMA concluded that “free and fair trade and a competitive climate in line with global rules benefit consumers in the United States and strengthen the sustainable growth of the U.S. auto industry and its economy. We will continue to monitor this situation closely and to uphold the vital importance of free trade worldwide.”

China YTD trade surplus with EU narrowed to USD 45.2B, with US widened to USD 104.9B

China’s trade surplus narrowed to USD 24.9B in May, below expectation of USD 32.5B. Exports rose 12.6% yoy to USD 212.8B while imports rose 26.0% yoy to USD 187.9B. in CNY terms, Exports rose 3.2% to CNY 1341B while imports rose 15.6% to CNY 1185B. Trade surplus narrowed to CNY 157B, below expectation of CNY 192B.

From January to May, exports to US rose 13.6% yoy to USD 175.17B while imports from the US grew 11.9% yoy to USD 70.32B. Trade surplus to the US was at USD 104.85B, widened from 2017 same period of USD 92.9B. Total trade with the US grew 13.1% to USD 245.50B.

For the same period, exports to EU rose 12.0% yoy to USD 155.39B while imports from EU rose 19.9% yoy to USD 110.21B. Trade surplus to EU was at USD 45.18B, narrowed from 2017 same period of USD 47.9B. Total trade with EU rose 15.1% yoy to USD 265.60B.

USD/JPY Mid-Day Outlook

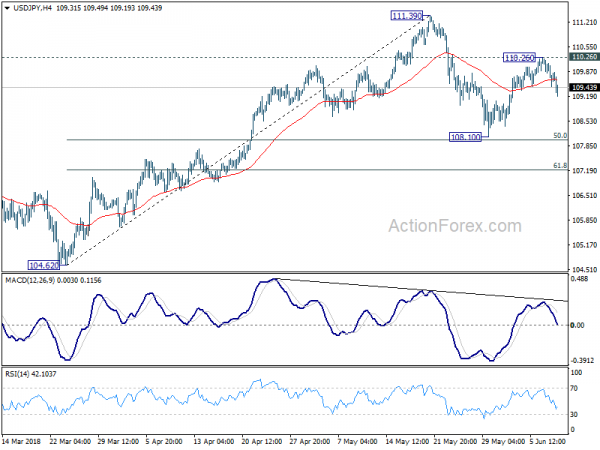

Daily Pivots: (S1) 109.39; (P) 109.79; (R1) 110.10; More…

Break of 109.46 minor support suggests that USD/JPY’s rebound from 108.10 has completed at 110.26 already. Intraday bias is turned back to the downside for 108.10 support or below. For now, price actions from 111.39 are seen as a corrective pattern. We’d expect strong support from 61.8% retracement of 104.62 to 111.39 at 107.20 to contain downside and bring rebound. Meanwhile, break of 110.26 resistance will resume the rebound to 111.39 resistance next.

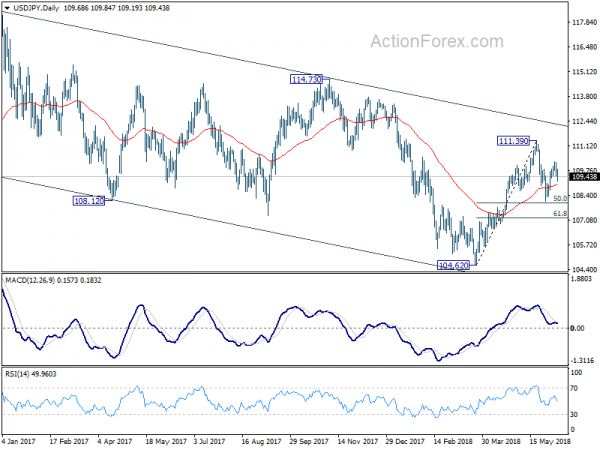

In the bigger picture, at this point, we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Apr | 1.89T | 2.09T | 1.77T | |

| 23:50 | JPY | GDP Q/Q Q1 F | -0.20% | -0.20% | -0.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 0.50% | 0.50% | 0.50% | |

| 03:15 | CNY | Trade Balance (CNY) May | 157B | 192B | 183B | |

| 03:23 | CNY | Trade Balance (USD) May | 24.9B | 32.5B | 28.8B | |

| 06:00 | EUR | German Trade Balance (EUR) Apr | 19.4B | 20.3B | 22.0B | 21.6B |

| 06:00 | EUR | German Industrial Production M/M Apr | -1.00% | 0.40% | 1.00% | |

| 12:15 | CAD | Housing Starts May | 196K | 217K | 215K | |

| 12:30 | CAD | Net Change in Employment May | -7.5K | 19.1K | -1.1K | |

| 12:30 | CAD | Unemployment Rate May | 5.80% | 5.80% | 5.80% | |

| 14:00 | USD | Wholesale Inventories M/M Apr F | 0.00% | 0.00% |