Swiss Franc and Euro are the strongest major currencies in a rather quiet day today. Mild recovery in German bund yield is giving the common currency a little lift. But the main drive in the forex market is Dollar’s weakness. The greenback is trading as the worst performing one. Yen follows closely as it continues to pare back last week’s gain. Canadian Dollar is the third weakest even though oil price is extending recent corrective rebound. Nevertheless, movements in the Loonie are relatively limited ahead of BoC rate decision later in the week.

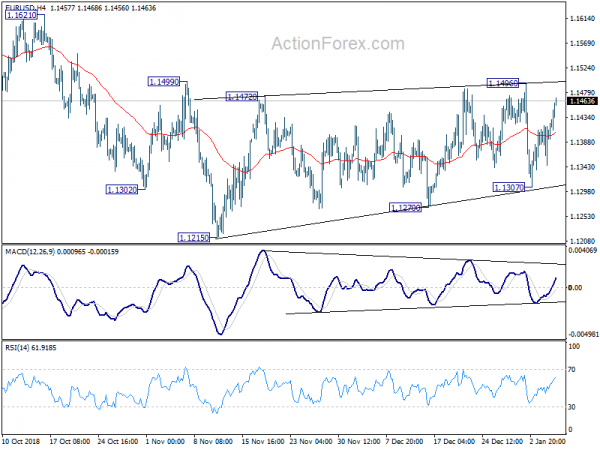

Technically, for now, EUR/USD is staying in range below 1.1499 near term resistance. Recent price actions from 1.1215 are still viewed as a consolidation pattern. Outlook in EUR/USD will stay bearish unless there is sustained break of 1.1499. Similarly, GBP/USD is also held below 1.2814 resistance, which keeps its outlook bearish. A focus ahead is whether USD/CHF would reversal from 0.9765/8 fibonacci cluster support, and whether USD/CAD would rebound from 1.3327 Fibonacci level.

In other markets, at the time of writing, FTSE is down -0.62%, DAX is down -0.70%, CAC is down -0.83%. German 10 year bund yield is up 0.0054 at 0.216. Earlier in Asia, Nikkei rose 2.44% and reclaimed 20000 handle. Singapore Strati Times rose 1.42%. But Hong Kong HSI and Shanghai SSE rose 0.82% and 0.72% respectively only. Investors are cautious as US-China trade talk resumes. Japan 10 year JGB yield rose 0.0173 to 0.016, staying negative.

Eurozone Sentix Investor Confidence dropped for the fifth month, neither politicians nor central banks are reacting

Eurozone Sentix Investor Confidence dropped to -1.5 in January, down from -0.3 but beat expectation of -2.0. Still, that’s the fifth decline in a row and situation and expectation fell slightly once again. Sentix noted that “What is worrying about the current loss of momentum is the policy’s unwillingness to react, which is obviously unaware of the possible implications. Investors do not expect a quick reaction from the central banks either.”

Also, Sentix added that “The US President, too, is becoming increasingly entangled in a secondary war theatre, and the US shutdown is strengthening the downward momentum in the USA as well. The US overall index falls for the third time to only 6.6 points. Eastern Europe and, above all, Latin America are viewed somewhat more positively.”

On Eurozone, Sentix warned that “the eurozone is dangerously close to stagnation”. And, “Neither politicians nor central banks seem to have really grasped the extent of this loss of momentum. The EU Commission’s agreement with Italy in the trade dispute is on the credit side. But the continuing protest of the yellow vests in France could weigh more heavily. The possible “hard Brexit” and the lack of support from the global economy remain negative factors.”

Also released from Eurozone, retail sales rose 0.6% mom in November, above expectation of 0.2% mom. German factory orders dropped -1.0% om in November, below expectation of -0.2% mom.

Brexit parliamentary vote to be held on Jan 15

BBC reported that the Commons will vote on Prime Minister Theresa May’s Brexit deal on Tuesday January 15. And May will give her last efforts to give further assurances that the controversial Irish backstop solution is only temporary. MPs are invited to meet with May tomorrow.

Over 200 MPs had signed a letter to May urging her to rule out a no-deal Brexit. However, former foreign minister Boris Johnson wrote in Daily Telegraph arguing that no-deal Brexit, “otherwise known as coming out on World Trade terms” is “closest to what people actually voted for” in the 2016 EU referendum.

Separately, a YouGov poll published on Sunday should that if a referendum were held immediately, 46% of Britons would vote to remain in the EU, 39% would vote to leave. Removing those undecided or refused to answer, the split was 54-46 in favor of remaining.

European Commission repeats there won’t be Brexit renegotiations

European Commission chief spokesman Margaritis Schinas said regarding the Brexit agreement. He said, “the deal that is on the table is the best and the only deal possible.” And, “this deal will not be renegotiated.” Additionally, there is no more scheduled negotiation talks as “negotiations are complete”.

Schinas described the phone call between EC President Jean-Claude Juncker and UK Prime Minister Theresa May last Friday as “friendly”. The two would speak again this week.

China-US trade talk resumed, Xi’s top aide Liu attended

US-China trade negotiation resumed in Beijing today. It’s originally arranged as a vice ministerial level meeting. But Vice Premier Liu He, Xi’s top official on trade, surprisingly attended the meeting too. Liu’s participation is seen by some that China is putting much effort to make a deal.

Foreign Ministry spokesman Lu Kang said that “From the beginning we have believed that China-U.S. trade friction is not a positive situation for either country or the world economy. China has the good faith, on the basis of mutual respect and equality, to resolve the bilateral trade frictions.”

Lu added, “As for whether the Chinese economy is good or not, I have already explained this. China’s development has ample tenacity and huge potential”. And, “We have firm confidence in the strong long-term fundamentals of the Chinese economy.”

Trump said on Sunday that “I think China wants to get it resolved. Their economy’s not doing well… “I think that gives them a great incentive to negotiate.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1356; (P) 1.1387; (R1) 1.1430; More…..

EUR/USD rebounds to as high as 1.1468 so far today but stays well below 1.1496 resistance. Intraday bias remains neutral first. Also, price actions from 1.1215 are still viewed as a corrective pattern. Thus, downside breakout is favored. On the downside, break of 1.1307 minor support will turn bias back to the downside for 1.1215 low. Break will resume down trend from 1.2555 to 1.1186 key fibonacci level. Nevertheless, sustained break of 1.1499 resistance will suggest near term reversal and bring stronger rebound back to 1.1621 resistance first.

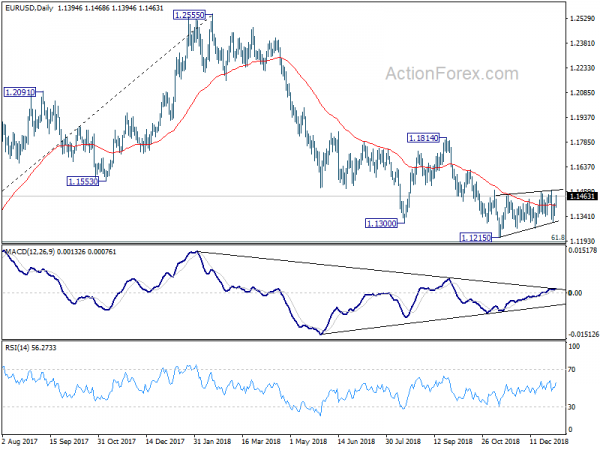

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Dec | 49.5 | 51.3 | ||

| 23:50 | JPY | Monetary Base Y/Y Dec | 4.80% | 5.80% | 6.10% | |

| 7:00 | EUR | German Factory Orders M/M Nov | -1.00% | -0.20% | 0.30% | 0.20% |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Jan | -1.5 | -2 | -0.3 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Nov | 0.60% | 0.20% | 0.30% | 0.60% |

| 15:00 | CAD | Ivey PMI Dec | 58.1 | 57.2 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Dec | 59.4 | 60.7 |