Euro stays firm against Dollar and Sterling in Asian session but is losing some momentum against commodity currencies. Strength of the common currency is built upon optimism on Eurozone’s economic outlook. And Euro will look into a string of data for further strength today, including PMIs and German IFO business climate. Meanwhile, Sterling stays as the weakest major currency as markets UK election and Brexit negotiation with EU are both approaching. Dollar, on the hand, stays soft too and didn’t follow the rebound in stocks and yield. US President Donald Trump’s first budget will also be a major focus today but it’s unlikely to be inspirational.

Pounds stays weak as May halt election campaign

Sterling continues to trade as the weakest major currency for the week as markets are already starting to get cautious ahead of the election next month. Prime Minister Theresa May halted her campaign after suspected terrorist attack in Manchester. May was criticized as having a U-turn on one of her key policies, a now called "dementia tax" on elderly people. It was originally widely expected that the Conservatives would have a landslide victory in the election on June 8. But latest poll, which showed only a lead of 9 pts over Labour, suggested that the margin was not as strong as it’s thought to be. And that would potentially give May a much weaker hand in Brexit negotiation.

EU is "ready and well-prepared" for Brexit talk

EU’s Brexit negotiator Michel Barnier said that the EU has agreed on its Brexit negotiating stance and he hoped that the first round of talk would begin in the week of June 19. Barnier said that "from the day the UK decided to leave, the EU has gone through an intense preparatory process," and, "we are ready and well-prepared." The "negotiating directives" were agreed unanimously at a meeting of 27 EU ministers yesterday. Here are some highlights of the 18 page document:

- UK will leave EU on March 30, 2019 unless EU27 agrees unanimously to extend the talks

- Status of EU citizens is the top priority and the Brexit agreement must ensure "effective, enforceable, non-discriminatory and comprehensive guarantees" for the 4.7m people and their families affected.

- EU and UK have to agree on a "single financial settlement" covering EU budget and UK contributions to European Investment Bank and other common funds. But there was no amount mentioned.

- On the island of Ireland, EU would hope to avoid a hard border while respective its legal order.

- EU emphasizes future UK governments can be held to account for failing to uphold the Brexit agreement. And EU proposes "an institutional structure to ensure an effective enforcement of the commitments" and refers to the importance of the European Court of Justice.

Euro supported by Merkel’s comments

Speaking in Berlin, German Chancellor Angela Merkel noted that the Euro is too weak, evidenced by the country’s strong trade surplus. She attributed the single currency’s weakness to ECB’s ultra–accommodative monetary policy. Separately, Bundesbank President Jens Weidmann suggested that domestic price pressures were currently ‘muted’, but reiterated his forecast that they would increase "with the continued economic upswing and the gradual decline in unemployment in the Eurozone".

Dallas Fed Kaplan reiterated "gradual and patient" rate path

In US, Dallas Fed President Robert Kaplan retained his view over a "gradual and patient" path on rates. While describing the recent dataflow as "disappointing", he reaffirmed that it is "an appropriate baseline case for the near-term path of the federal funds rate". On inflation, Kaplan noted that the "progress toward our 2% inflation goal has been slow and, at times, uneven". Yet, he noted patience is needed "in critically assessing upcoming data to evaluate whether we are continuing to make progress in reaching our inflation objective".

Fed Governor Lael Brainard said that policy makers "aren’t seeing much progress on core inflation". Instead, "if anything the last few months we’ve seen some stalling out of core inflation." And, she urged Fed officials to look deeper into the employment market and see how different demographic groups are doing. She emphasized that "understanding these barriers and efforts to address them is vital in assessing maximum employment as well as potential growth." While Brainard didn’t touch on monetary policy directly, her comments suggested that she’s not totally convinced by a more hawkish path.

Looking head…

US President Donald Trump’s administration will deliver the first full budget today. According to the budget documents from the White House, the US economy is projected to grow at 3% in 2021 and continue at that pace afterwards. That’s a pace never seen since 2005 and is significantly higher than the Congressional Budget Office’s 1.9% potential. US will also release PMI manufacturing and services, as well as new home sales.

Earlier in European session, Eurozone, Germany and France PMI manufacturing and services will be featured. Germany will also release Q1 GDP final and Ifo business climate. Swiss will release trade balance while UK will release CBI reported sales.

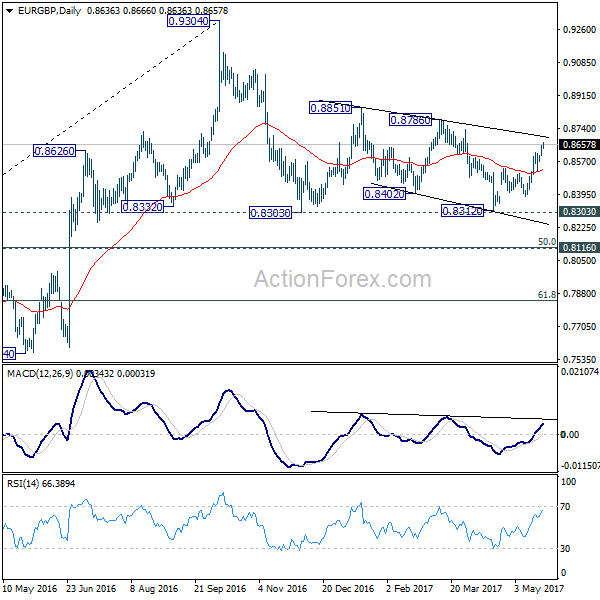

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8612; (P) 0.8631; (R1) 0.8664; More…

Intraday bias in EUR/GBP remains on the upside as current rise from 0.8132 extends to as high as 0.8660 so far. Further rally is expected to be seen to 0.8786 resistance next. Note again that price actions 0.9304 are viewed as a medium term corrective pattern that is extending. Break of 0.8786 would now pave the way to retest 0.9304 high. For now, break of 0.8523 support is needed to indicate completion of the rebound form 0.8312. Otherwise, near term outlook will remain mildly bullish in case of retreat.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. In case of deeper fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Rise from 0.6935 (2015 low) will resume at a later stage to 0.9799 (2008 high). However, sustained break of 0.8116 could bring deeper decline to next key support level at 0.7564 before the correction completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | All Industry Activity Index M/M Mar | -0.50% | 0.70% | ||

| 06:00 | CHF | Trade Balance (CHF) Apr | 3.10B | |||

| 06:00 | EUR | German GDP Q/Q Q1 F | 0.60% | 0.60% | ||

| 07:00 | EUR | France Manufacturing PMI May P | 55.2 | 55.1 | ||

| 07:00 | EUR | France Services PMI May P | 56.7 | 56.7 | ||

| 07:30 | EUR | Germany Manufacturing PMI May P | 58 | 58.2 | ||

| 07:30 | EUR | Germany Services PMI May P | 55.5 | 55.4 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 56.5 | 56.7 | ||

| 08:00 | EUR | Eurozone Services PMI May P | 56.4 | 56.4 | ||

| 08:00 | EUR | German IFO – Business Climate May | 113.1 | 112.9 | ||

| 08:00 | EUR | German IFO – Expectations May | 105.4 | 105.2 | ||

| 08:00 | EUR | German IFO – Current Assessment May | 121 | 121.1 | ||

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Apr | 8.0b | 4.4b | ||

| 10:00 | GBP | CBI Realized Sales May | 10 | 38 | ||

| 12:30 | CAD | Wholesale Sales M/M Mar | 1.00% | -0.20% | ||

| 13:45 | USD | US Manufacturing PMI May P | 53.1 | 52.8 | ||

| 13:45 | USD | US Services PMI May P | 53.2 | 53.1 | ||

| 14:00 | USD | New Home Sales Apr | 610K | 621K |